Smarter Indexing, Better Results: 10 Reasons to Consider Dimensional and Avantis

Whilst Dimensional Fund Advisors (DFA) and Avantis Investors both offer systematic, broadly diversified portfolios that resemble index funds in many ways, their strategies are intentionally constructed to tilt towards known sources of higher expected returns. They do so in a way that may outperform traditional market-cap-weighted indexes like those offered by Vanguard.

Here’s a comprehensive breakdown of the nuances that underpin their potential to outperform:

1. Factor Exposure: Targeting Sources of Higher Expected Return

Whereas Vanguard’s index funds replicate the market by holding stocks in proportion to their market capitalisation, Dimensional and Avantis tilt their portfolios towards factors associated with long-term excess returns:

Key Factors:

Value: Stocks with low prices relative to fundamentals (e.g. book-to-market, earnings-to-price)

Size: Smaller companies tend to have higher expected returns than large cap stocks

Profitability: Firms with high operating profitability tend to outperform

Momentum (Avantis more so than Dimensional): Stocks with recent strong performance tend to continue to outperform in the short term

2. More Precise Implementation than Style Box Funds

Dimensional and Avantis don't rely on broad, crude factor buckets (e.g. ‘value’ from Morningstar style boxes). Instead, they use:

Multidimensional sorting: Selecting securities based on multiple signals simultaneously (e.g. small-cap + high profitability + deep value)

Dynamic rebalancing: Allowing flexibility to capture factor premiums as market prices shift, rather than rigidly adhering to calendar-based rebalancing.

As Gerard O’Reilly of Dimensional explains: ‘we do that every day. A little bit, five basis points, ten basis points of turnover a day… Participate, don’t initiate. We don’t want to be the ones initiating the trades, we want to be the ones participating in the natural volume in the marketplace (O’Reilly 2022).’

As an example to differentiate between the two approaches, a Vanguard Value ETF may have significant exposure to large-cap banks or energy firms with low price-to-book but poor profitability, whereas Avantis and DFA might screen these out if they don’t have robust fundamentals.

3. Sophisticated Trading & Liquidity Management

Rather than chasing index additions/removals or trading on a fixed schedule, Dimensional and Avantis:

Trade opportunistically: Waiting for favourable bid/ask spreads and avoiding liquidity traps

Use algorithmic execution: Minimising market impact by not broadcasting their trades

Delay trades where appropriate: Accepting small tracking error vs. benchmarks in order to improve execution costs

This can reduce implementation shortfall, which is an often-overlooked drag on net returns for many index trackers.

4. Systematic Rules without Being Slaves to the Index

By not being tied to an index, they can:

Avoid forced buying of overvalued IPOs or index entrants

Prevent fire sales when a company drops out of an index

Reduce turnover by maintaining trading flexibility

Index funds must match their benchmark precisely, which introduces structural inefficiencies that DFA and Avantis avoid.

5. Inclusion of ‘Out-of-Index’ Stocks

Especially in the small-cap space, DFA and Avantis portfolios may include securities that are not in conventional indexes:

Small-cap stocks just below the cutoff of Russell 2000 or CRSP indexes

Foreign stocks or REITs not eligible for specific benchmarks

These securities may be under-researched or mispriced, creating an opportunity for enhanced returns — particularly when combined with profitability/value screening.

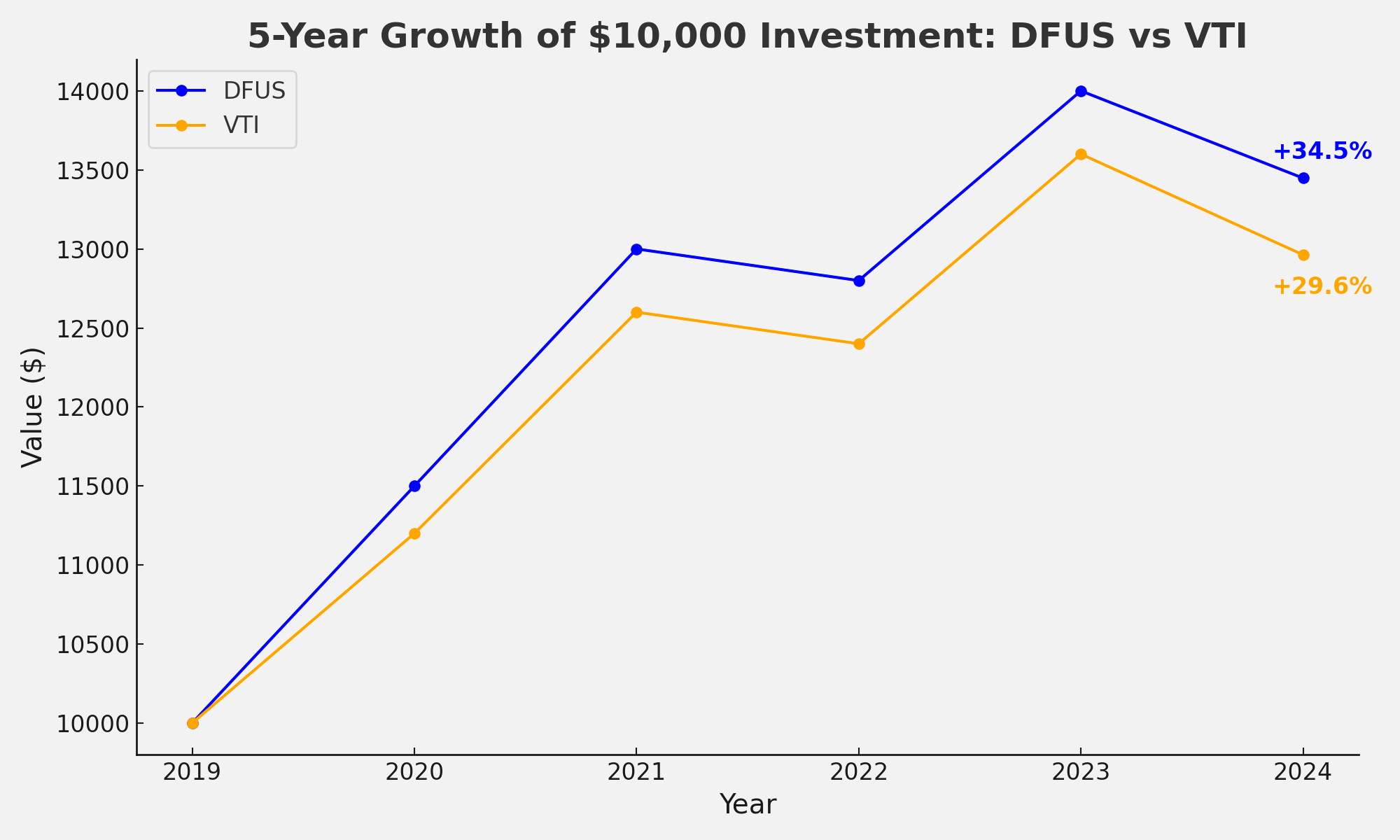

Figure 1. This chart compares the growth of a $10,000 investment in Dimensional U.S. Equity Market ETF (DFUS) and Vanguard Total Stock Market ETF (VTI) over a 5-year period.

DFUS ends with a total return of +34.5%, whilst VTI trails slightly at +29.6%.

Both funds provide broad exposure to the US equity market, but DFUS applies slight tilts towards smaller and more profitable companies, along with flexible trading strategies to reduce hidden costs.

This outperformance highlights how strategic portfolio design can enhance returns over time, even when tracking similar market segments.

6. Tax Efficiency (Especially in Avantis ETFs)

Avantis leverages the ETF structure to:

Use in-kind redemptions to manage capital gains

Harvest losses through strategic trading, similar to direct indexing

Rotate portfolios to maintain factor exposures without realising gains

Dimensional has also introduced ETFs in recent years with similar mechanics. This offers an edge over traditional mutual fund structures (though Vanguard’s ETF share class structure is also extremely tax efficient).

7. Global Diversification with Integrated Currency & Market Considerations

Whilst Vanguard often builds global portfolios by stacking regional indexes together, Dimensional and Avantis optimise at the portfolio level:

Incorporating expected returns, factor exposures, tax efficiency, and trading costs simultaneously

DFA's international small cap strategies, for instance, reflect more exposure to small-value companies abroad than a broad MSCI EAFE small-cap tracker would

Avantis even overlays currency risk considerations for certain international funds

8. Firm Philosophy: Consistency, Patience, and Execution

Both firms are:

Research-driven: Grounded in academic insights from Fama, French, Novy-Marx, et al.

Long-term-oriented: Avoiding short-term market timing or trend-chasing

Disciplined: Committing to systematic rules that mitigate behavioural biases

This helps reduce poor investor outcomes due to performance chasing or style drift — risks that can erode returns in actively managed funds and even among index investors who tinker with allocations.

9. Lower Costs than Active, Higher Value Than Pure Passive

Neither DFA nor Avantis is ‘cheap’ like a basic Vanguard index ETF, but their costs are:

Lower than traditional active (often ~0.20–0.35%)

Justified by the additional return drivers (factors, tax efficiency, trading alpha)

Given the evidence that factors like value and profitability offer long-term risk premia, these modest fees are arguably compensated for via enhanced expected returns.

10. Behavioural Edge for Advisers and End Clients

Because DFA and Avantis strategies are:

Broadly diversified

Long-term oriented

Not easily compared to standard benchmarks

They may help investors stay the course — avoiding the performance-chasing that plagues investors who switch between sectors, thematic ETFs, or active funds. Behavioural alpha, whilst not explicit, is real.

Conclusion

Dimensional and Avantis aren't guaranteed to outperform, but they do offer a structurally enhanced investment process over traditional index funds. This is achieved by using academic insights and advanced implementation techniques to increase the probability of capturing higher expected returns through factor tilts, improved trading execution, and smart portfolio design.

Vanguard excels at giving investors the market return for rock-bottom cost. Dimensional and Avantis aim to offer a slightly higher return via a systematic process but without making bets on individual stocks or managers.

References

O’Reilly, Gerard. 2022. Interview by Ben Felix and Cameron Passmore. Rational Reminder Podcast, episode 198, May 12, 2022. https://rationalreminder.ca/podcast/198