Does Gold Deserve a Place in Your Portfolio?

Gold has fascinated humans for millennia. From Roman coins to central bank vaults, it has long been regarded as a store of value and a hedge against crisis. But how well does gold actually perform as an investment? And should modern retail investors consider allocating to it within a diversified portfolio?

This post explores gold’s role through both a historical and financial lens, comparing it with equities, bonds, commercial property and cash. It assesses long-term returns, volatility, correlation with other asset classes, and the ability to hedge against inflation, asking not whether gold is timeless, but whether it is truly useful.

The Golden Constant

The idea that gold preserves purchasing power over time, what economist Roy Jastram dubbed the ‘golden constant’, has strong historical roots. The pay of a Roman centurion in gold roughly equated to that of a modern US army captain (Erb and Harvey 2013). Over thousands of years, gold has demonstrated remarkable price stability in real terms, maintaining its function as a durable store of wealth. This longevity supports gold’s reputation as monetary insurance, particularly during currency crises or geopolitical stress.

Whilst gold may protect purchasing power over the very long term, it does not inherently grow wealth. It pays no income, generates no cash flow, and relies solely on price appreciation to deliver returns. In that sense, it differs sharply from productive assets like equities and property.

Return on Gold vs Other Asset Classes

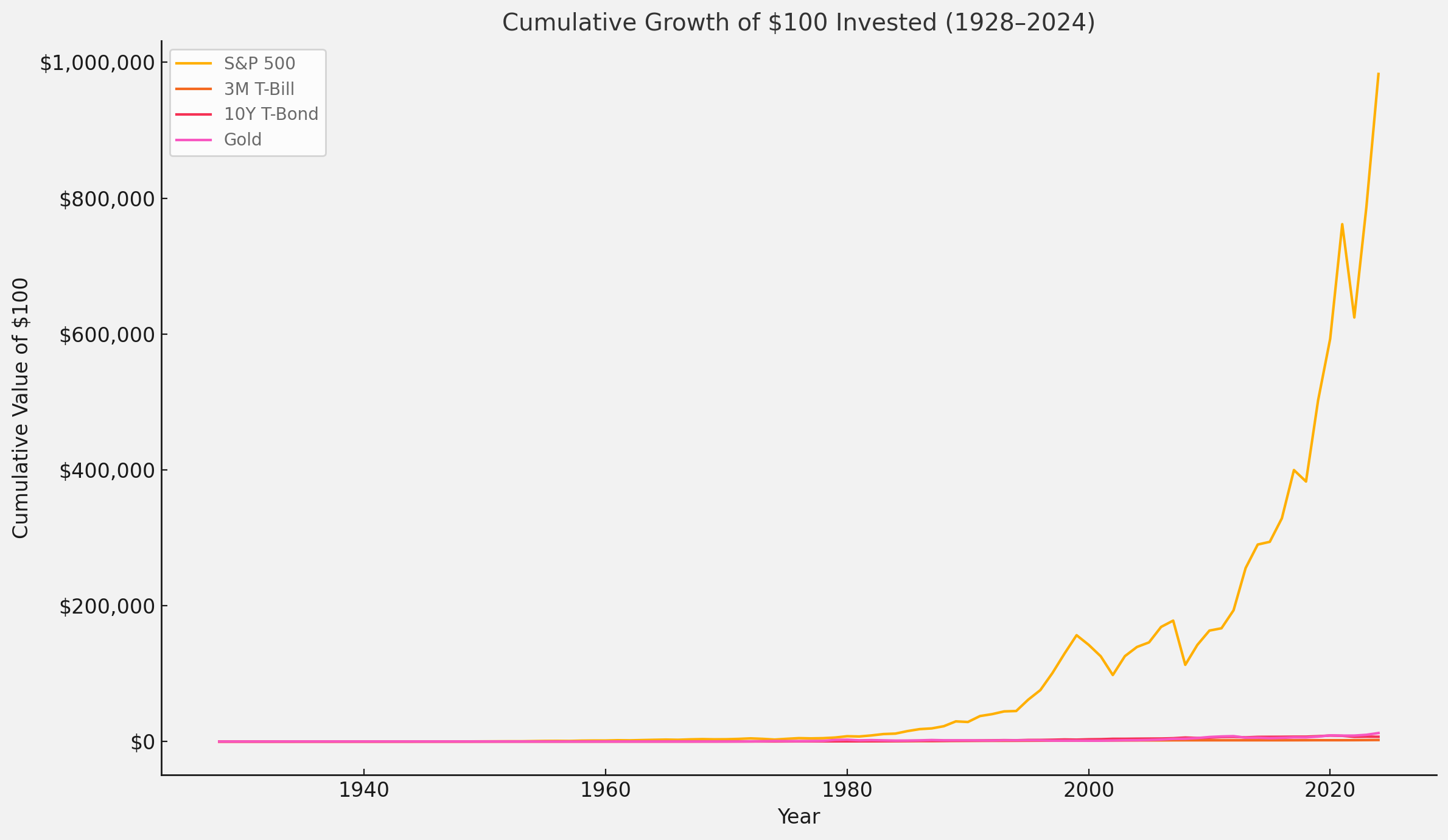

Over the modern era, gold has delivered moderate but inconsistent returns. From 1928 to 2024, gold produced an average annual return of around 5.1 per cent, compared to 9.9 per cent for the S&P 500, 4.5 per cent for 10-year US government bonds, and 3.3 per cent for 3-month Treasury bills (Asness, Israelov, and Liew 2013; Damodaran 2024). Gold’s performance surged following the end of the gold standard in 1971, rising over 8 per cent annually since then, but those gains were heavily concentrated in the 1970s and early 2000s (World Gold Council 2023).

Critically, gold’s return profile varies dramatically by holding period. In the 1980s and 1990s, gold delivered negative real returns. Between 2000 and 2020, however, it outpaced equities, rising nearly ninefold. This variability makes gold attractive in some decades but unreliable over others. Over a typical 40-year investment horizon, equities have historically outperformed gold by a wide margin.

Figure 1. This chart shows how $100 invested in the S&P 500, gold, 10-year US Treasury bonds, or 3-month Treasury bills grew over time.

Equities clearly dominate, turning $100 into nearly $1 million. Gold and bonds preserved capital but lagged significantly. Even small differences in annual return compound into huge gaps over long periods.

Data taken from Damodaran (2024).

A Quick Way to Grasp the Power of Compounding

It’s hard to intuitively grasp just how much difference a few percentage points of return can make over a long time horizon. A 10 per cent annual return doesn’t sound dramatically better than 5 per cent, until you run the maths.

Here’s a simple mental shortcut:

£100 × 1.10⁹⁶ = £941,234

£100 × 1.05⁹⁶ = £10,819

That’s an 87-fold difference. Not because of some miracle fund manager, but purely due to the mathematics of compounding over 96 years. It’s why equities have historically created such vast wealth, even if they’re more volatile in the short run.

A Risky Safe Haven

Gold’s reputation as a ‘safe haven’ can be misleading. Whilst it often performs well during crises, it is anything but stable. Its annual volatility hovers around 15 per cent—on par with equities and well above that of bonds or cash (Erb and Harvey 2013). In other words, gold can swing dramatically in price, even as it protects during market stress.

For example, gold gained more than 20 per cent during the global financial crisis from 2007 to 2009, but then fell roughly 30 per cent between 2012 and 2015. A ‘safe’ asset with such drawdowns is more akin to insurance with lumpy payoffs than a low-risk investment. Whilst its volatility can be uncomfortable, gold’s appeal lies not in smoothness, but in behaving differently when it matters most.

Diversification and Portfolio Construction

Gold’s most compelling role is as a diversifier. Across decades, its correlation with equities and bonds has averaged near zero (Erb and Harvey 2013; World Gold Council 2023). Importantly, gold often exhibits negative correlation during equity bear markets. In one study of eleven major drawdowns in US equities, gold prices rose in eight of them (Harvey and Erb 2013).

This negative beta during crises gives gold portfolio utility. Adding a small allocation, typically 5 to 10 per cent, has historically reduced drawdowns and improved risk-adjusted returns. It is one of the few assets that reliably ‘zigs’ when others ‘zag’. Unlike commercial property, which tends to fall alongside equities in downturns, gold has repeatedly shown resilience during panic episodes.

Inflation Hedge: Myth or Reality?

Gold is often described as an inflation hedge, but only partly deserves the title. Over centuries, gold has preserved real value, rising broadly in line with inflation. However, over shorter periods, even decades, it is a highly unreliable hedge. Empirical studies show little correlation between year-to-year inflation and gold’s price (Erb and Harvey 2013).

Gold excelled in the 1970s during double-digit inflation, but fared poorly in the 1980s and 1990s despite positive inflation. More recently, gold lagged during parts of the 2021–2022 inflation surge. Unlike inflation-linked bonds or real assets like property, gold’s performance is driven more by investor sentiment and macro-economic uncertainty than by actual inflation prints.

That said, gold remains a useful tail-risk hedge, particularly in the face of unexpected or extreme inflation, currency debasement or sovereign stress. It functions less like a CPI tracker and more like insurance against monetary regime failure.

How to Own Gold: Physical vs ETFs

Retail investors today have two primary routes to gold exposure: physical bullion and ETFs. Physical gold offers direct ownership, free from counterparty risk, but comes with storage, insurance and liquidity challenges. ETFs, such as SPDR Gold Shares (GLD) or iShares Gold Trust (IAU), provide low-cost, highly liquid exposure to physical gold held in vaults.

The returns from both are broadly identical, aside from small ETF fees. For most investors, ETFs offer the most practical way to integrate gold into a portfolio. Physical gold may still appeal to those with distrust of the financial system, but for typical allocation and rebalancing purposes, ETFs dominate on convenience and cost.

Conclusion: A Strategic Allocation, Not a Core Holding

Gold is not a growth asset. Over centuries, it has preserved value rather than created it. Unlike stocks, it does not compound. Unlike bonds, it does not pay an income. But it plays a role that neither of those assets can: it diversifies portfolios, performs well in crises, and hedges against extreme macro-economic risks.

For retail investors with long time horizons, equities and bonds should remain the backbone of wealth building. But a small, strategic allocation to gold, particularly via ETFs, can enhance resilience. As ever, the key is balance. Too little gold and you forgo diversification; too much and you sacrifice growth.

References

Asness, Clifford, Roni Israelov, and John Liew. 2013. ‘Fact, Fiction, and Value Investing’. The Journal of Portfolio Management 40 (1): 24–36.

Damodaran, Aswath. 2024. ‘Historical Returns on Stocks, Bonds and Bills: 1928–2024’. Stern School of Business, NYU.

https://pages.stern.nyu.edu/~adamodar/

Erb, Claude B., and Campbell R. Harvey. 2013. ‘The Golden Dilemma’. Financial Analysts Journal 69 (4): 10–42.

Harvey, Campbell R., and Claude B. Erb. 2013. ‘The Golden Constant: Real Price of Gold, 1257–2013’. Research Affiliates.

https://www.researchaffiliates.com/publications/articles/318-the-golden-constant

World Gold Council. 2023. ‘Gold as a Strategic Asset’.

https://www.gold.org/goldhub/research