Inflation Swaps In A Short-Duration Bond Fund

Using Dimensional’s Sterling Short Duration Real Return Fund As The Example

If you want UK inflation protection, the obvious route is index-linked gilts. The problem is that the UK linker market is relatively narrow and tends to push you towards longer-duration exposure, so a ‘real return’ approach can end up being dominated by real-rate duration and price volatility. Dimensional’s design choice in the Sterling Short Duration Real Return Fund is to separate these moving parts: they keep the underlying bond portfolio short and diversified (by including investment-grade credit), and then ‘attach’ inflation sensitivity via an overlay of UK RPI inflation swaps (Dimensional Fund Advisors Ltd. 2024; Dimensional Fund Advisors Ltd. 2025).

That is the big idea to keep in mind throughout this piece: a physical index-linked gilt bundles inflation linkage together with real-rate duration. A swap overlay lets you target inflation exposure without being forced into long duration as the price of admission. This does not make the fund ‘risk free’ or ‘a pure inflation hedge’, but it does change which risks you are choosing to hold and how those risks show up in the fund’s day-to-day behaviour.

Why Use Swaps Instead Of Just Buying Linkers?

A physical linker is often misunderstood as a simple ‘inflation hedge’. It is linked to inflation, but it is still a bond, so its price is sensitive to discount rates. In particular, inflation-protected bonds can move materially when real yields move, and that price volatility tends to be larger when duration is long. Dimensional’s own description of the problem is that investors in index-linked gilts are constrained to a limited set of mainly longer-duration securities and therefore take on the interest-rate sensitivity and volatility that comes with long duration (Dimensional Fund Advisors Ltd. 2024). The KIID-style framing also highlights that inflation-protected securities can fall when real interest rates rise (Dimensional Fund Advisors Ltd. 2025).

So the motivation for swaps is not ‘derivatives are clever’. It is more basic: swaps allow the fund to pursue inflation-aware outcomes whilst keeping the portfolio’s interest-rate sensitivity in a short-duration range, and whilst still making room for diversified investment-grade credit exposure (Dimensional Fund Advisors Ltd. 2024).

What An Inflation Swap Is

An inflation swap is a derivatives contract where two parties exchange cashflows: one leg is linked to realised inflation and the other leg is linked to a fixed rate agreed up front. In a zero-coupon inflation swap, nothing is exchanged until maturity; at maturity, there is one net settlement payment based on the difference between the two legs (Fleming and Sporn 2013).

Let:

N= notional amount (e.g., £100m)I₀= inflation index level at inceptionI_T= inflation index level at maturityK= fixed inflation swap rate agreed at inceptionT= term in years

Then the legs can be written as:

Inflation Leg = N × [(I_T / I₀) − 1]

Fixed Leg = N × [(1 + K)^T − 1]

Net Payment (To The Inflation Receiver) = Inflation Leg − Fixed Leg

The reason the fixed rate K is often described as a ‘breakeven’ is that the swap is generally priced so its value is roughly zero at inception. That fixed rate is what the market is willing to exchange for realised inflation over that time horizon, incorporating expectations as well as risk, liquidity, and market-structure effects (Fleming and Sporn 2013; Bahaj et al. 2023).

Who Benefits When Inflation Is Higher Or Lower?

The directional intuition is simple.

If realised inflation ends up higher than the fixed rate, the inflation leg is larger, so receiving inflation is beneficial.

If realised inflation ends up lower than the fixed rate, the fixed leg is larger, so receiving fixed is beneficial.

A compact way to express that intuition is:

Swap Payoff ≈ N × (π_realised − π_fixed)

Where π_fixed is the fixed rate embedded in the swap at inception and π_realised is the inflation outcome over the relevant horizon. This is not a pricing identity, and real-world swaps have conventions (lags, indexation rules, discounting) that matter for valuation. But as a mental model for what the exposure means, it is the right place to start (Fleming and Sporn 2013).

A Worked Example With Numbers

Assume:

N= 100T= 5 yearsK= 2.5% per year

Then the fixed leg is:

Fixed Leg = 100 × [(1.025)^5 − 1] = 13.14

So the swap is saying:

‘I will pay you realised inflation over 5 years (the inflation leg), and in return you pay me a pre-agreed amount (fixed leg) equivalent to 2.5% inflation compounded for 5 years.’

That pre-agreed amount is 13.14 per 100 of notional, i.e. 13.14% cumulative inflation over 5 years.

Now consider two inflation outcomes.

Case A: Inflation Averages 4% Per Year

Inflation Leg = 100 × [(1.04)^5 − 1] = 21.67

So:

Net Payment = 21.67 − 13.14 = 8.52

The inflation receiver benefits.

Case B: Inflation Averages 1% Per Year

Inflation Leg = 100 × [(1.01)^5 − 1] = 5.10

So:

Net Payment = 5.10 − 13.14 = −8.04

Now the fixed receiver benefits (the inflation receiver pays the net amount).

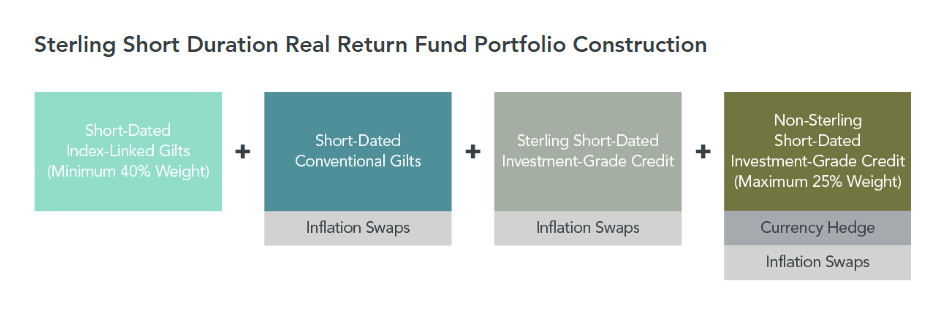

Figure 1. Dimensional Fund Advisors Ltd. (2024) ‘Dimensional launches Sterling Short Duration Real Return Fund’, 1 May.

Why The UK Market Focuses On RPI

In the UK, inflation swaps have historically been heavily referenced to RPI, consistent with the long-standing role of RPI-linked instruments in the UK inflation-linked market. Evidence using UK inflation swap data highlights that RPI dominates the bulk of contracts observed in trade repositories, and that the market is segmented by participant type and maturity horizon (Bahaj et al. 2023). For the Dimensional fund, the practical point is that the fund’s stated inflation objective is framed against UK RPI, so it is natural that the derivative overlay is also described as using UK RPI inflation swaps (Dimensional Fund Advisors Ltd. 2024; Dimensional Fund Advisors Ltd. 2025).

How Dimensional Uses Inflation Swaps In A Short-Duration Fund

Dimensional’s launch description is explicit: the fund aims to maintain potentially lower price volatility by investing in short-duration UK gilts (conventional and index-linked), broaden the opportunity set and increase expected return via short-duration investment-grade corporate bonds, and then add an inflation hedge to that nominal bond exposure through inflation swaps, with non-sterling currency exposure hedged to GBP (Dimensional Fund Advisors Ltd. 2024). The KIID-style description also notes that the fund may use derivatives including inflation swaps, and may use swaps to seek inflation protection (Dimensional Fund Advisors Ltd. 2025).

A helpful way to understand the structure is as three sleeves.

Short-Duration Government Bonds

This sleeve provides liquidity, ballast, and duration control. It is also operationally useful because derivatives create collateral and margin flows: a portfolio that holds substantial high-quality liquid assets can meet margin calls without being forced into selling riskier holdings at the wrong time. In plain terms, the government sleeve is part risk management and part derivatives ‘plumbing’.

Short-Duration Investment-Grade Credit

This sleeve exists to harvest the credit premium. Dimensional’s framing is that a linker-only approach confines you to government securities only for which there are limited shorter duration assets. Furthermore, it leads you to forgo one of the key components of fixed income’s expected performance: exposure to the credit premium (Dimensional Fund Advisors Ltd. 2024). The flip side is that you are taking on credit spread risk, and inflation swaps do not eliminate that risk.

The Inflation Swap Overlay

This overlay is the ‘real return’ component. Economically, a natural way to obtain inflation protection through swaps is to receive realised RPI and pay fixed inflation. Interpreted that way, the swap exposure is best thought of as an insurance-like position against inflation turning out higher than the fixed rate that was priced when the swap was entered. It is not free. The fixed rate reflects the market’s required compensation to exchange fixed for realised inflation, including premia that move through time (Fleming and Sporn 2013; Bahaj et al. 2023).

Nominal Bonds Plus Inflation Swaps = Synthetic ‘Real Return’ Exposure

A short-duration nominal bond portfolio has exposures to nominal rates (limited by short duration), credit spreads (if corporates), and liquidity premia. What it does not provide is direct protection against inflation surprises. The swap overlay is the mechanism that adds an explicit inflation sensitivity without requiring the portfolio to hold long-duration index-linked gilts.

A clean way to frame the combined structure is:

Portfolio Return ≈ Nominal Bond Return + Inflation Swap Return − Frictions

Where:

Nominal bond return is driven by carry, roll-down, yield changes, and (for corporates) spread changes.

Swap return is driven by inflation outcomes versus what was priced, and by mark-to-market changes in inflation pricing through time.

Frictions include bid–offer spreads, rolling swaps as they mature, and collateral/margin economics.

This is the core reason that the approach exists: it lets the fund pursue a more inflation-aware return profile whilst keeping the portfolio’s duration and opportunity set aligned with a short-duration strategy (Dimensional Fund Advisors Ltd. 2024).

What You Are Actually Exposed To Day To Day

Holding this fund is not the same as holding ‘inflation’. You are holding a blend of risks.

First, there is short-duration interest-rate exposure, which the fund deliberately keeps within a short range. Second, there is credit spread exposure from the investment-grade corporate sleeve, which is a key source of expected return versus a government-only inflation-linked approach (Dimensional Fund Advisors Ltd. 2024). Third, there is inflation surprise exposure from the swap overlay: realised RPI above the fixed leg tends to help; realised RPI below the fixed leg tends to hurt. Finally, there is the additional layer of derivatives implementation risk (counterparty, valuation, liquidity, operational) which the KIID-style risk framing explicitly highlights, including the fact that hedging effectiveness is not guaranteed (Dimensional Fund Advisors Ltd. 2025).

Short duration reduces one major source of bond volatility, but it does not eliminate risk. The fund is still exposed to the same broad categories that drive short-duration credit portfolios, plus the way inflation and inflation pricing evolve relative to what was locked in when swaps were entered.

Who Takes The Other Side Of The Swap?

It is almost never helpful to imagine one ‘speculator’ sitting opposite the fund. The immediate counterparty is typically a dealer, but the economic opposite side is distributed through the market as dealers hedge, offset, and recycle risk through other clients and instruments. Evidence from UK inflation swap markets suggests a segmented ecosystem: pension funds tend to transact at longer horizons, hedge funds tend to transact at shorter horizons, and dealer banks are central intermediaries across segments (Bahaj et al. 2023).

For a fund investor, the practical message is that inflation protection is delivered through a chain of intermediation. The end result can still be robust, but it is not as simple as ‘we swapped with someone who guessed wrong’.

What The Structure Hedges Well, And What It Does Not

What It Hedges Well

The swap overlay is best described as hedging:

Unexpected UK RPI inflation relative to what was priced into the fixed rate

That is the real-return feature you are buying when the fund receives realised inflation and pays fixed.

What It Does Not Hedge

It does not automatically hedge:

Real yield shocks. Inflation-protected outcomes can still move when real rates move, and that sensitivity is not zero just because duration is short (Dimensional Fund Advisors Ltd. 2025).

Credit spread widening. A short-duration credit sleeve will generally detract when spreads widen sharply. Why? Because when spreads widen, the market reprices that risk higher, so the bonds’ required yield rises and prices fall which detracts from returns.

Liquidity stress. Derivatives introduce margin dynamics, and liquidity management becomes important in stressed markets.

The honest framing is: the fund is designed to be inflation-aware without long-duration linker dominance, not to eliminate every risk that matters to fixed income investors.

Conclusion

Inflation swaps are mechanically simple once you reduce them to two legs: fixed inflation exchanged for realised inflation on a notional amount. Dimensional’s short-duration real return approach is a portfolio engineering decision: keep the bond portfolio short and diversified (so duration and credit carry are controllable), then add inflation sensitivity using RPI inflation swaps rather than relying solely on long-duration linkers (Dimensional Fund Advisors Ltd. 2024; Dimensional Fund Advisors Ltd. 2025). If you remember one line, it is this: a physical linker bundles inflation and real-rate duration, whereas a swap overlay lets you target inflation without being forced into long duration.

References

Bahaj, Saleem, Robert Czech, Sitong Ding, and Ricardo Reis. 2023. ‘Decoding the Market for Inflation Risk’. Bank Underground (Bank of England staff blog).

Dimensional Fund Advisors Ltd. 2024. ‘Dimensional Launches Sterling Short Duration Real Return Fund’. Press release / launch announcement.

Dimensional Fund Advisors Ltd. 2025. Sterling Short Duration Real Return Fund: Key Investor Information Document (KIID). Dated 3 November 2025.

Fleming, Michael J., and John R. Sporn. 2013. ‘Trading Activity and Price Transparency in the Inflation Swap Market’. FRBNY Economic Policy Review 19 (1): 45–57.