Property or Investment Portfolio? A Deep Dive into UK Buy-to-Let vs Stocks and Bonds

‘If I won the lottery, I’d spend a bit and invest the rest in property.’

That was a friend of mine recently, casually outlining what he’d do with a hypothetical windfall. It’s a sentiment I’ve heard many times: when it comes to investing, property is the go-to strategy for a lot of people in the UK. It feels tangible, familiar, and secure.

I countered with a different suggestion, investing in a globally diversified stock and bond portfolio. He seemed intrigued, if a little sceptical. And that’s what prompted this post: how does a buy-to-let investment stack up against long-term investing in a stock and bond portfolio?

Let’s dig into the numbers.

The Appeal of Buy-to-Let in the UK

Buy-to-let property has long been a favourite among British investors. The rationale is straightforward:

You earn regular rental income.

The property (hopefully) appreciates in value.

You have a physical asset you can see and touch.

However, this simplicity hides a number of complications. Let’s break it down.

1. Rental Yields

According to Hamptons and ONS data, average gross rental yields in the UK are around 4–5%, but after costs, maintenance, lettings fees, insurance, mortgage interest, void periods and tax, net yields typically fall to 2–3%.

2. Capital Growth

UK property prices have grown by approximately 2–3% per year above inflation over the long term, although this varies significantly by region (ONS 2023). More recently, house price growth has slowed or stalled in many areas.

3. Costs and Friction

Buy-to-let investing is not frictionless:

As at June 2025:

Stamp duty on second properties adds 3% on top of standard rates.

Capital gains tax (CGT) is both 18% or 24% for second homes or taxable investment accounts depending on your marginal tax rate.

Since 2020, mortgage interest relief has been restricted to a 20% basic rate tax credit.

Ongoing maintenance, tenant management, and legal obligations make buy-to-let anything but passive.

The Alternative: Stocks and Bonds

A globally diversified investment portfolio offers an appealing contrast:

High liquidity

Diversification across thousands of companies and governments

Low ongoing costs

Tax efficiency through ISAs and pensions

Minimal maintenance

Let’s evaluate expected returns.

1. Long-Term Return Expectations

Global equities have delivered around 7% per year above inflation (Dimson, Marsh, and Staunton 2023).

Global bonds have returned closer to 1–2% per year above inflation, depending on credit quality and duration.

A 60/40 global stock/bond portfolio might return 5% above inflation, whilst a 100% global equity portfolio could return closer to 7%.

2. Risk and Volatility

Stock portfolios are more volatile day-to-day, but this risk can be diversified globally and managed over time. Property feels more stable simply because prices aren’t quoted every minute. But the risks are still there: tenant defaults, repair costs, and local market downturns.

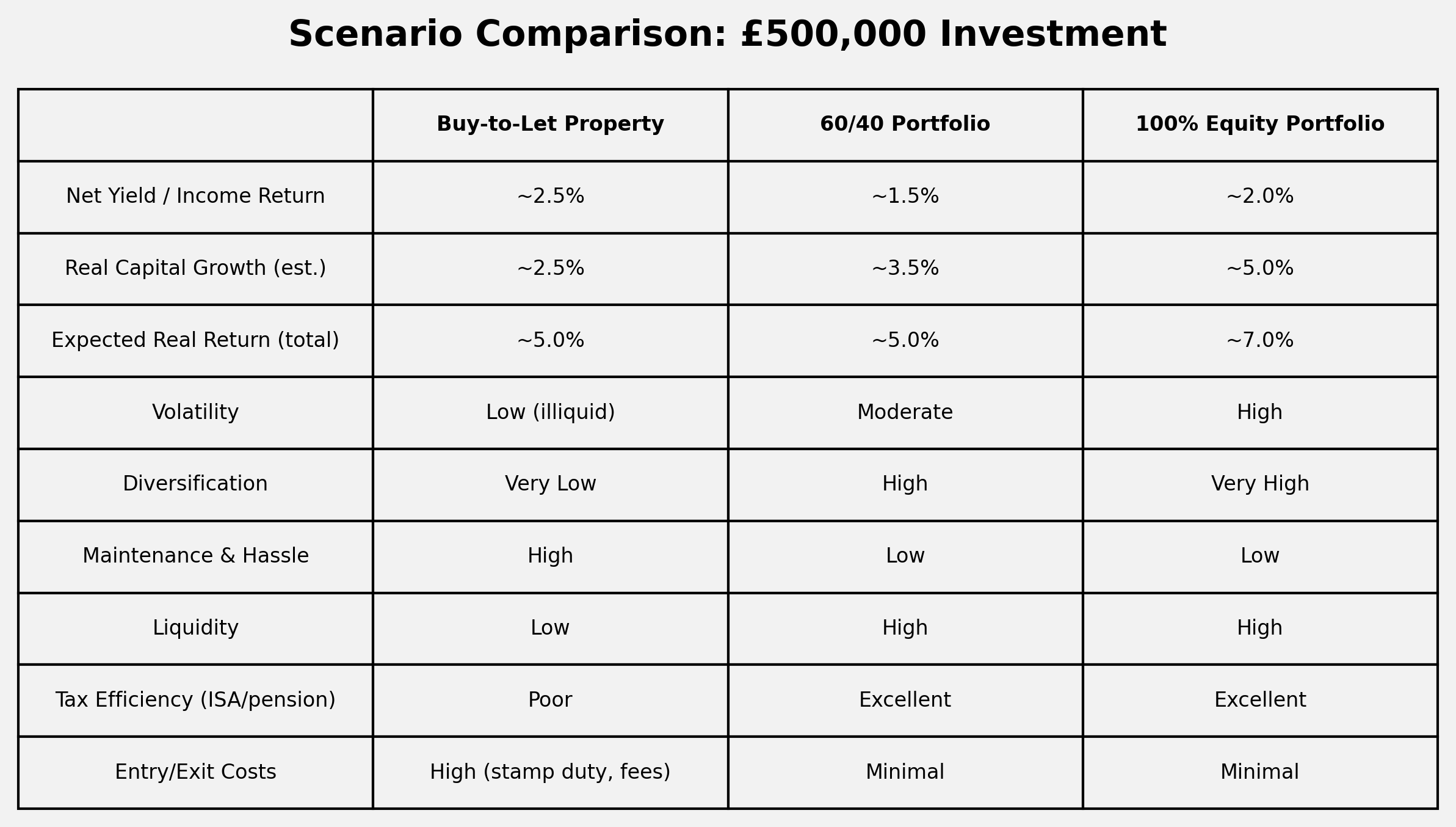

Scenario Comparison: £500,000 Investment

Suppose our lottery winner wants to invest £500,000. How would the options compare?

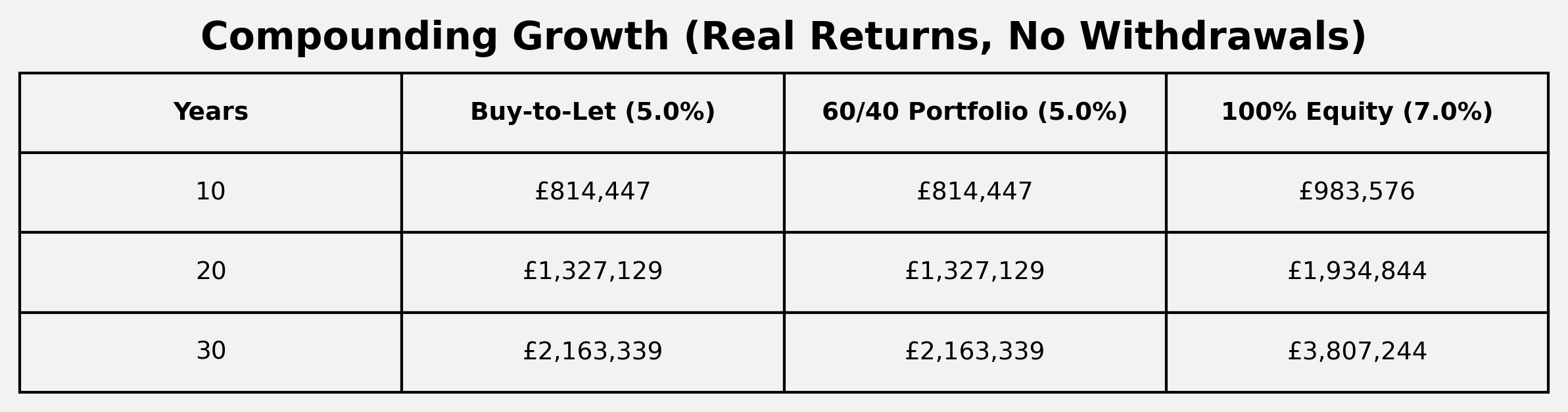

The Power of Compounding

The difference in expected returns may seem small—but over time, it becomes substantial. Here’s how £500,000 grows under each strategy assuming no withdrawals and inflation-adjusted returns:

Source: author calculations. Assumes real returns and full reinvestment.

Even the 60/40 portfolio matches buy-to-let on returns whilst offering greater liquidity, diversification, and ease. And for those willing to take more risk, a 100% equity portfolio can grow wealth nearly twice as fast over 30 years.

Why Property Feels Safer (Even If It Isn’t)

Behaviourally, property feels secure because we don’t see price movements every day. But that doesn’t mean it’s risk-free. Property is:

Highly concentrated (one asset, one location)

Illiquid

Time-intensive

Vulnerable to regulation and taxation changes

Meanwhile, a globally diversified portfolio spreads your investment across thousands of companies in dozens of countries and requires no hands-on involvement.

Final Thoughts: Know What You’re Really Getting Into

This isn’t to say property is always a bad investment. For some, particularly those with time, skill, and a strong local knowledge, buy-to-let can work. But it’s not the slam-dunk many people assume it to be and it comes with major frictions that diversified portfolios do not.

For most long-term investors, especially those who want to grow wealth passively and efficiently, a globally diversified stock and bond portfolio is likely to deliver better results, with far less hassle.

So, if you win the lottery… maybe don’t rush to become a landlord.

References

Dimson, Elroy, Paul Marsh, and Mike Staunton. 2023. Credit Suisse Global Investment Returns Yearbook 2023. Credit Suisse Research Institute.

Office for National Statistics (ONS). 2023. UK House Price Index.

Hamptons. 2024. Rental Market Monthly Report.

Hale, Tim. 2023. Smarter Investing: Simpler Decisions for Better Results. 4th ed. Pearson.