Should You Hedge Currency Risk in Your Portfolio?

Currency exposure is an often-overlooked dimension of investment risk. Yet for UK investors with globally diversified portfolios, it plays a critical role, especially in the context of fixed income and equity allocations. Should you hedge currency risk? The answer depends on what part of your portfolio you’re talking about.

Defensive Assets: Hedge Everything

The easy starting point is to eliminate currency exposure from your defensive holdings. In a portfolio context, the role of defensive assets, typically high-quality bonds (fixed interest), is to provide stability, reduce overall volatility, and act as a counterbalance during periods of equity market stress. Adding the volatility of foreign exchange markets into this mix defeats the purpose of holding fixed interest in the first place.

If you hold foreign bonds (say, global aggregate bond funds), you are not just taking on interest rate and credit risk; you’re also exposed to the unpredictability of currency movements. These movements can introduce equity-like levels of volatility into what should be your portfolio’s safe harbour. As Hale (2023) explains, the purpose of fixed income is to provide stability within a portfolio. Introducing foreign exchange risk into this component compromises its role as a dependable anchor. For that reason, Tim strongly advocates that global bond holdings be fully hedged back to sterling.

Currency risk in bonds is particularly uncompensated, there’s no clear evidence of a long-run return premium for taking it on (Ilmanen 2011). This means you are increasing risk without increasing expected return. Therefore, for global bond exposure, ensure you’re using a hedged share class that brings everything back to GBP.

Moreover, executing currency hedging strategies is not something that should be done at the DIY level. The operational complexity, rolling forward contracts, managing slippage, adjusting for interest rate differentials, makes it something best handled by fund managers at the product level.

Rule of Thumb: Own GBP bonds where possible. If owning global bonds, use GBP-hedged funds.

Equities: Unlikely to Be Worth It

When it comes to equities, the case for hedging currency exposure is far weaker.

Currency returns and equity market returns have historically shown weak or no correlation (Hale 2023). If UK equities tended to fall at the same time as sterling weakened (or rose when it strengthened) - then the case for hedging might be stronger. But the data don’t support that (Hale 2023). As Vanguard (2020) points out, currency fluctuations tend to diversify rather than amplify equity risk, particularly over the long term.

More importantly, equity market volatility tends to be significantly higher than currency volatility. Even though exchange rate movements can be large and unpredictable, they are usually swamped by the much larger price swings of equity markets themselves. This means that the standard deviation of a global equity portfolio is largely driven by equity price movements, not currency.

As a result, the difference in volatility between hedged and unhedged global equity portfolios is generally small. Furthermore, currency fluctuations may even offer a diversification benefit, softening losses in times of stress. Hale (2023) captures this idea well: ‘currencies zig when markets zag, sometimes helping, sometimes hurting, but over time it comes out in the wash’.

Rule of Thumb: Leave global equities unhedged. Currency exposure is part of the package.

What Do the Data Say?

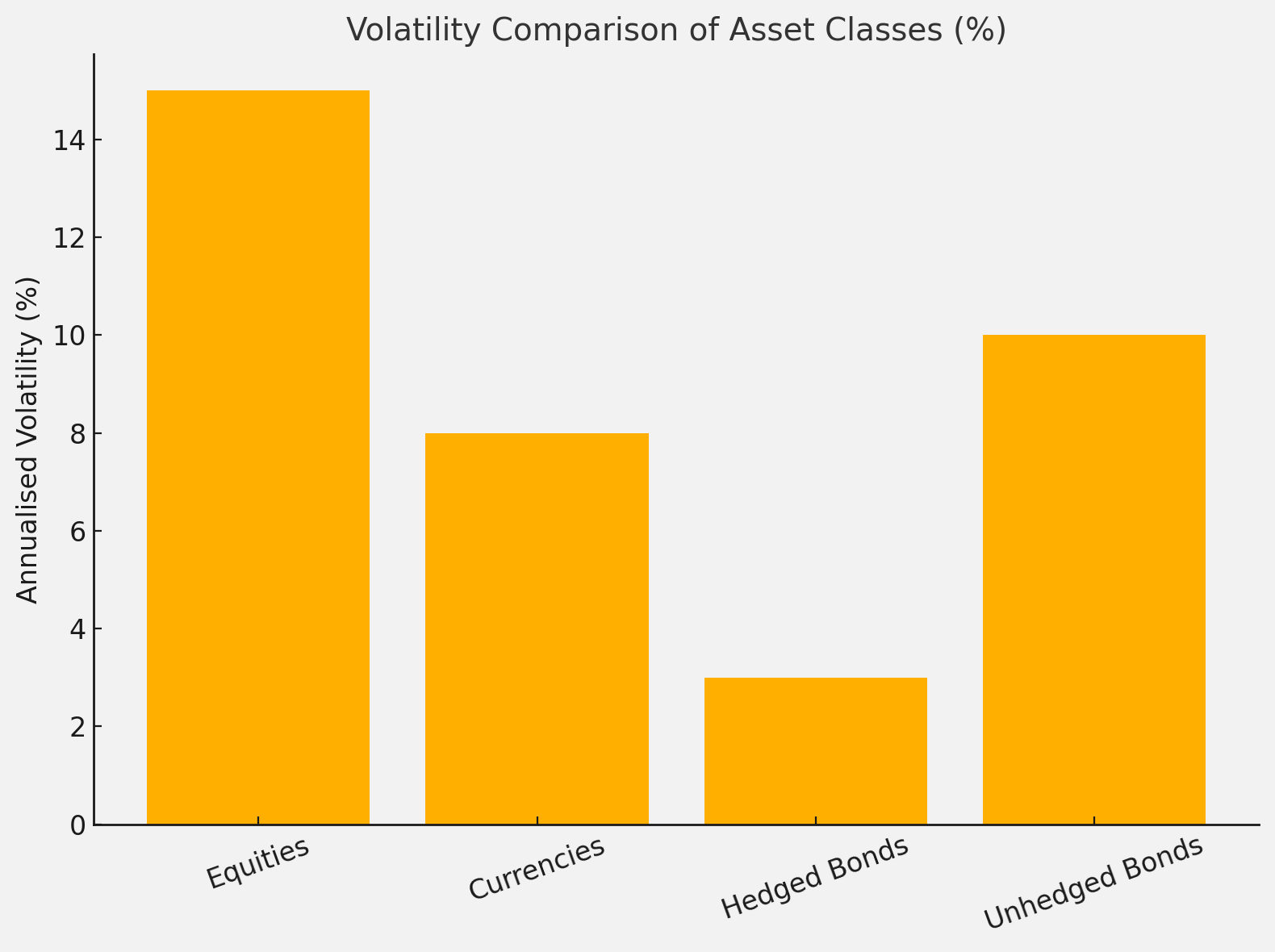

Figure 1. The chart compares the approximate annualised volatility of four asset classes: global equities, currency markets, hedged bonds, and unhedged bonds. These figures are illustrative and rounded for clarity:

Chart Summary and Assumptions

Equities: ~15% annualised volatility, based on historical global equity data (MSCI World Index).

Currencies: ~8% annualised volatility. Currency pairs like GBP/USD or EUR/USD exhibit significant variability but typically less than equities (Ilmanen 2011).

Hedged Bonds: ~3% annualised volatility, representing the typical behaviour of GBP-hedged high-quality global bond funds (Vanguard 2023).

Unhedged Bonds: ~10% annualised volatility due to combined interest rate, credit, and currency risk (Vanguard 2020).

Further Assumptions and Rationale

Equity and bond volatilities are based on long-term historical averages across global diversified indices.

Currency volatility is derived from major developed-market currency pair data.

Volatility for unhedged bonds includes an uplift from foreign exchange (FX) risk.

Hedged bond volatility assumes currency risk is neutralised using forward contracts or similar instruments.

Figure 2. The chart above illustrates the importance of currency hedging in the context of global government bond investing for sterling-based investors. It compares the cumulative performance of two versions of the FTSE World Government Bond Index – Developed Countries: one hedged to GBP and the other unhedged, alongside a composite FX blend (USD/JPY/EUR vs GBP). Source: Banker on Wheels (2020).

What the Chart Shows

Maroon Line (Top): This represents the performance of GBP-hedged global bonds. The line is smooth and upward-sloping, reflecting steady returns and low volatility, exactly what you’d expect from a defensive asset class. The impact of foreign exchange is removed, leaving only interest rate and credit risk.

Pink Line (Middle): This line tracks unhedged global bonds. The same underlying bonds are held, but now the returns are influenced by currency movements. As a result, the line is bumpier and more volatile. At times, currency swings enhance returns; at other times, they detract from them.

Grey Line (Fluctuating): This is a composite FX blend that captures the relative strength of major foreign currencies (USD, JPY, EUR) against the British pound. It exhibits sharp fluctuations, particularly during periods of financial crisis or geopolitical instability (e.g. the 2008 financial crisis or Brexit-related volatility).

Key Takeaways

Currency Volatility Adds Noise to Bond Returns

The unhedged bond index mirrors many of the swings seen in the FX blend, confirming that currency exposure adds equity-like volatility to what should be a stabilising asset class.

Hedging Helps Preserve Bonds’ Defensive Role

The hedged bond index maintains a smoother upward trajectory, better fulfilling its purpose as the low-risk ballast of a diversified portfolio.

FX Movements Are Unpredictable

The grey FX line underscores the unpredictability of currency markets. Over shorter horizons, FX moves can dominate bond returns—but over the long run, the average contribution of currency exposure tends to net out, whilst the volatility remains.

The Bottom Line

For UK investors, currency exposure in global bonds is generally not rewarded. There is no reliable long-term premium for taking it on, and the added volatility weakens the portfolio's overall structure. Hedging global bonds back to GBP helps ensure that fixed income plays its intended role: stability, not speculation.

Figure 3. Dimensional Scatter Plot of Annual Currency Returns: Next Year vs This Year.

The horizontal axis shows the annual currency return in each calendar year, and the vertical axis shows annual currency return in the following year. Returns for each currency are against the Australian dollar. The graph shows that there is no predictability from past to future currency returns. That is, just because a currency did well (or poorly) in one year doesn’t reliably mean that it will continue to do so in the next year.

The regression slope is small (near zero), the t-statistics are weak and the R-squared is close to zero. In other words, extrapolating currency trends (e.g. ‘the AUD went up last year, so it’ll keep going up’) is generally a bad idea given the historical evidence. This undermines attempts to time currency hedging because the currency swings are largely unpredictable from one year to the next.

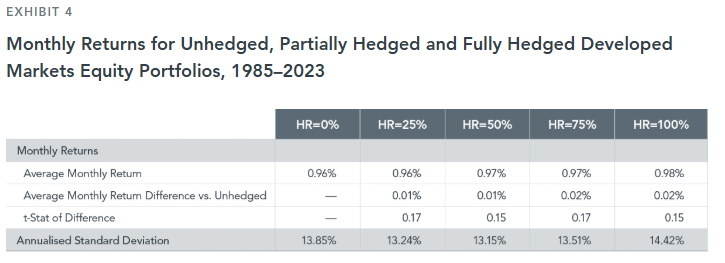

Average monthly returns are almost identical across all hedging levels (0.96%–0.98%). The differences are tiny (0.01%–0.02%) and not statistically significant (t-stats well below 2). In other words, hedging did not materially increase or decrease returns. Annualised standard deviation falls modestly when portfolios are partially hedged (lowest at 50% hedge, 13.15% vs 13.85% unhedged), but rises again if you go to a fully hedged position (14.42%).

Summary

Currency hedging decisions should align with the role of the asset in your portfolio. For defensive assets like bonds, hedge it all, either by owning sterling-denominated bonds or choosing a GBP-hedged global bond fund. For growth assets like equities, accept the currency exposure and focus on the bigger picture: long-term equity returns.

In the complex world of global investing, a simple rule set like this can help investors avoid unforced errors and stay focused on what matters.

References

Banker on Wheels. 2020. ‘Currency Royale: Should You Hedge Your Bonds?’. Accessed 25 May 2025. https://www.bankeronwheels.com/etf-currency-risk/

Dimensional Fund Advisors. Hedging Decisions for Equities. March 22, 2024. Available at: https://www.dimensional.com/au-en/insights/hedging-decisions-for-equities

Hale, T. 2023. Smarter Investing: Simpler Decisions for Better Results. 4th ed. FT Publishing International.

Ilmanen, Antti. 2011. Expected Returns: An Investor’s Guide to Harvesting Market Rewards. Chichester: Wiley.

MSCI. 2025. ‘MSCI World Index Factsheet’. MSCI. Accessed 25 May 2025. https://www.msci.com/documents/10199/178e6642-3f56-4b32-9f21-14fefb2e4d0c

Vanguard. 2020. ‘To Hedge or Not to Hedge: Currency Hedging in Global Equity Portfolios’. Vanguard Research. https://www.vanguard.com.hk/documents/to-hedge-or-not-to-hedge.pdf

Vanguard. 2023. ‘Vanguard Global Aggregate Bond Index Fund – GBP Hedged’. Vanguard UK. Accessed 25 May 2025. https://www.vanguardinvestor.co.uk/investments/vanguard-global-aggregate-bond-index-fund-gbp-hedged-acc