Why Stocks Belong in Every Investor’s Portfolio

When constructing an investment portfolio, one of the most fundamental questions is how to allocate capital across different asset classes. Among the options, bills, bonds, property, commodities and cash, stocks have consistently stood out as the asset class with the highest expected return over the long run. Despite their inherent volatility, they play a critical role in building wealth and protecting purchasing power over time.

Note: The terms ‘stocks’ and ‘equities’ are used interchangeably throughout this article. Both refer to shares in publicly traded companies, giving investors partial ownership and a claim on future earnings.

The Superior Returns of Equities

Historical evidence has long shown that stocks, or equities, provide higher average returns compared to other asset classes. According to the well-known Credit Suisse Global Investment Returns Yearbook, global equities have returned about 5–7% per year above inflation since 1900, outperforming bonds, bills, and cash in almost every market over long periods* (Dimson, Marsh, and Staunton 2023).

This outperformance can be attributed to the equity risk premium, the extra return investors demand for bearing the greater risk associated with owning shares in companies. Stocks are inherently riskier than government bonds or savings accounts, as company earnings can fluctuate, markets can be volatile, and businesses can fail. But in exchange for this uncertainty, investors are compensated with higher long-term returns.

Compounding and Time Horizon

One of the most powerful tools in an investor’s arsenal is compounding, earning returns on previous returns. The higher the return, the more impactful compounding becomes. A long-term investor who starts early and holds a diversified portfolio of equities benefits significantly from this effect.

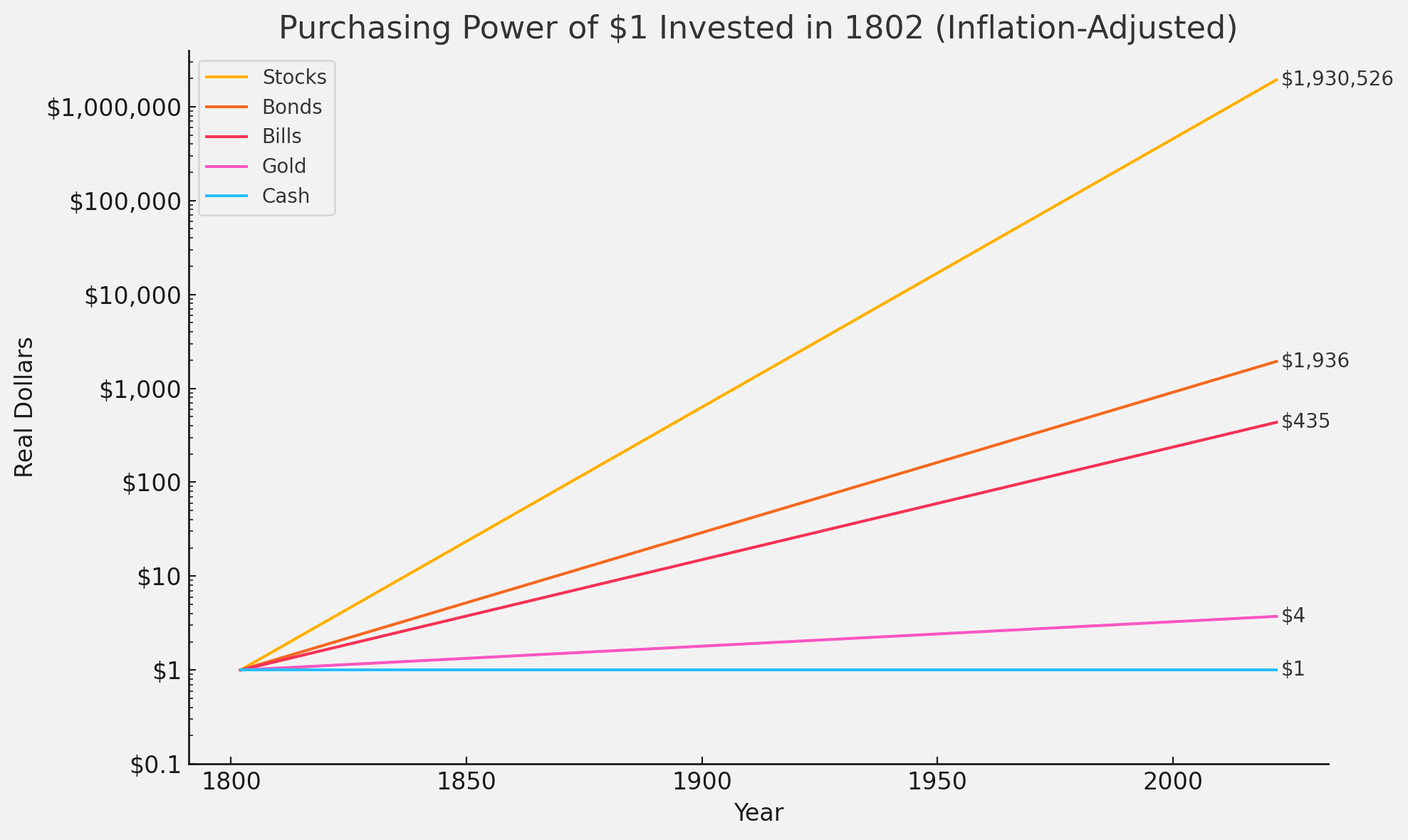

For instance, Jeremy Siegel, in his landmark book Stocks for the Long Run, shows how US stocks returned an average of 6.8% annually after inflation between 1802 and 2021, compared to 3.5% for long-term government bonds (Siegel 2022). Over decades, that difference can lead to dramatically higher portfolio values.

Beating Inflation

Another critical reason to include stocks in a portfolio is their ability to outpace inflation. While cash and bonds may lose real value during inflationary periods, equities often represent claims on real assets, businesses with pricing power, productive capital, and the ability to adapt. Over time, these characteristics allow many companies to maintain or increase their profit margins, thereby protecting investors’ purchasing power.

During the inflationary 1970s, for example, equities eventually recovered and resumed their upward trajectory, whereas fixed income investors suffered real losses. While equities are not immune to inflation shocks in the short term, history suggests they offer superior inflation protection over the long term.

Figure 1. Historical data adapted from Siegel (2022). The graphic illustrates long-term return estimates and how different assets have either gained or lost purchasing power since 1802.

Diversification and Risk Management

Of course, stocks should not be the only asset in a portfolio. They are volatile, and market downturns can be severe, as seen in 2008 or during the early stages of the COVID-19 pandemic. But for investors with a long investment horizon, such drawdowns tend to be temporary. A well-diversified stock portfolio, spread across countries and sectors, can mitigate idiosyncratic risks and reduce overall volatility.

Furthermore, the inclusion of other asset classes like bonds, real estate, and commodities can reduce portfolio drawdowns and enhance risk-adjusted returns through diversification. Yet equities typically form the core growth engine of a portfolio.

Final Thoughts

While no investment is without risk, stocks offer the highest expected return of any major asset class, driven by the equity risk premium and the power of compounding. They are also one of the best defences against inflation. For investors aiming to grow their wealth over the long term, a meaningful allocation to equities is not just advisable, it is essential.

References

Dimson, Elroy, Paul Marsh, and Mike Staunton. Credit Suisse Global Investment Returns Yearbook 2023. Zurich: Credit Suisse Research Institute, 2023.

Siegel, Jeremy J. Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies. 6th ed. New York: McGraw-Hill Education, 2022.

*In the Credit Suisse Global Investment Returns Yearbook 2023, the authors—Elroy Dimson, Paul Marsh, and Mike Staunton, emphasise that to truly understand risk and return in capital markets, one must examine periods much longer than 20 or even 40 years. They argue that due to the volatility of stocks and bonds, very long time series are necessary to support inferences about investment returns. This perspective is based on their comprehensive dataset, which spans over 120 years, covering 35 countries and encompassing all major asset classes.

Therefore, when the Yearbook states that 'equities have returned about 5–7% per year above inflation since 1900,' it refers to this extensive period of over a century as the 'long period' necessary for such analysis.