Does Owning Lots of Funds Actually Improve Diversification?

Diversification is often referred to as the only free lunch in investing. It’s one of the core principles for reducing risk and achieving more consistent returns. But how much diversification is enough? And does owning a large number of different funds actually make your portfolio safer?

Let’s explore whether piling up funds materially improves diversification, or whether it’s just giving the illusion of safety.

Quantity vs. Quality of Diversification

At first glance, owning ten different funds might seem more diversified than owning just one or two. But the number of funds you hold tells you surprisingly little about your actual risk exposure. What matters far more is what’s inside those funds.

If you hold several funds that all track similar markets, like multiple global equity index funds, you're likely just duplicating your exposure to the same companies. You haven’t meaningfully diversified; you’ve just spread your bets across different wrappers holding the same assets (Swedroe and Berkin 2015).

Is a Single Fund Properly Diversified?

In many cases, yes. A well-constructed global equity fund with exposure to more than 50 companies across various regions and industries already achieves substantial diversification. Once you're invested across that many stocks, you’ve largely eliminated idiosyncratic risk—the risk tied to any one company (Statman 1987).

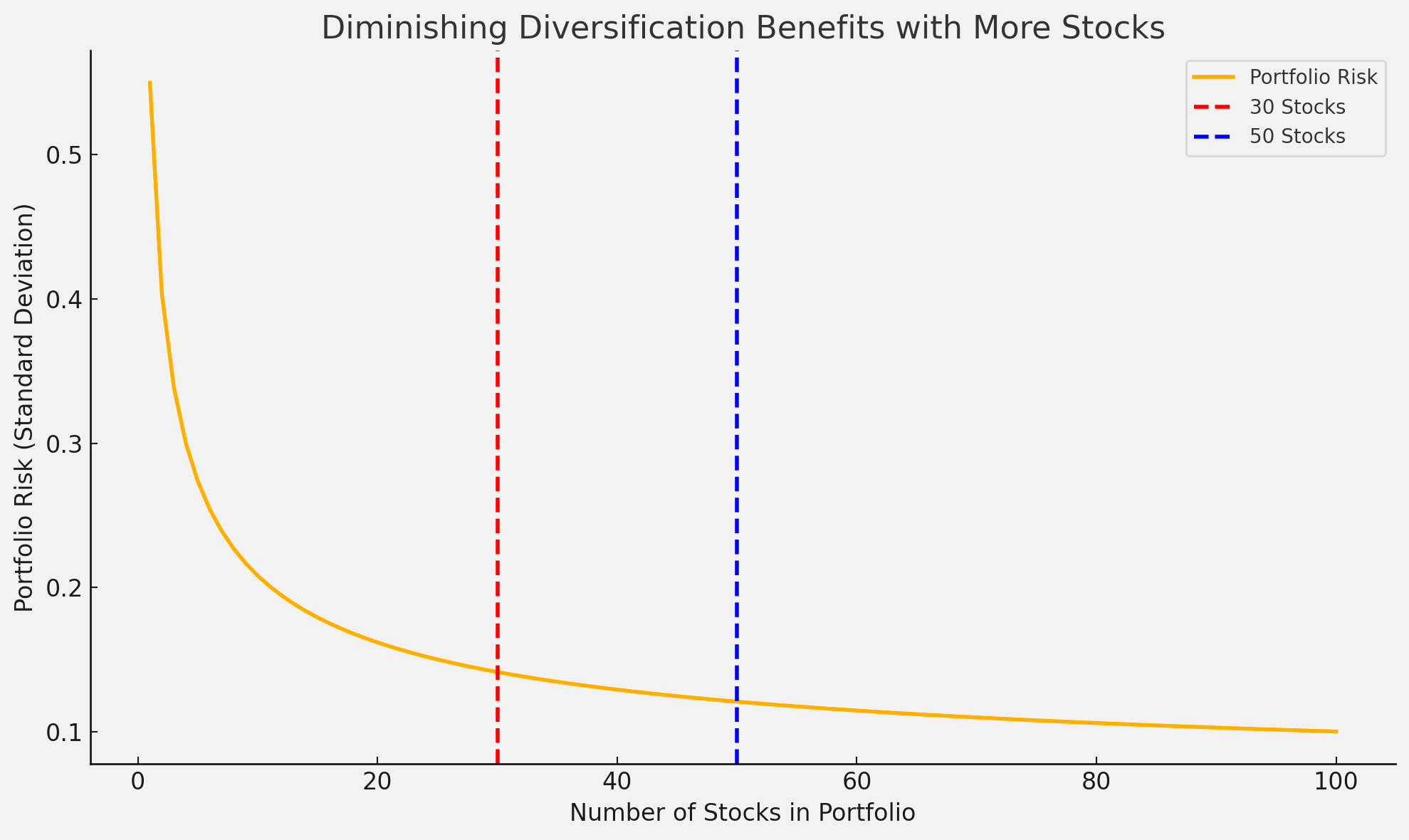

It’s important to note that the benefits of diversification diminish rapidly after a certain point. Studies show that the marginal benefit of adding more stocks drops significantly after about 30 to 50 holdings (Evans and Archer 1968). Owning more than one fund doesn’t automatically reduce your risk, especially if those additional funds are highly correlated with the first.

Some investors and advisers worry about putting all of their (or their client’s) money into a single fund due to ‘manager risk’, the idea that if the fund company (say, Vanguard) were to go bankrupt, their investment might be jeopardised. But this concern is largely unfounded. The assets in a fund are ring-fenced and held separately from the fund management company. If the provider were to collapse, the fund itself would continue to exist and would simply need to be taken over by another manager. The underlying investments wouldn’t be affected (Financial Conduct Authority 2021).

Figure 1. Portfolio risk reduces significantly up to around 30–50 stocks, after which the benefits of diversification diminish rapidly. Data adapted from Evans and Archer (1968).

The Illusion of Diversification

It’s not uncommon to see DIY investors (and some advisers) holding 10–20 funds, thinking they’ve built a fortress of diversification. But if most of those funds are global equity trackers with similar holdings, Apple, Microsoft, Amazon, etc., then in reality, you’ve just layered up the same exposures.

Diversification isn’t about numbers. It’s about ensuring your assets behave differently in different scenarios (Statman 1987).

What Really Drives Diversification

True diversification comes from:

Different asset classes — e.g., equities, bonds, real estate, cash

Different regions — developed and emerging markets, local and international

Different factors — like size, value, quality, and momentum

Low correlations — assets that don’t all move in the same direction at the same time

Owning multiple funds only helps if each one brings something new to the table (Swedroe and Berkin 2015).

When Multiple Funds Can Make Sense

That said, there are valid reasons to hold several funds:

To fine-tune your exposure to certain regions, sectors, or investment styles

To combine ETFs and mutual funds depending on the account type

For tax optimisation or to manage platform limitations

To add tilts (e.g., small-cap, value) that aren’t in your core holdings

But every fund you add should serve a distinct purpose.

Conclusion

Don’t confuse complexity with sophistication. A portfolio with three well-chosen funds may be far more diversified than one with 15 near-identical holdings. Owning more funds doesn’t necessarily reduce your risk, it might just increase your admin.

Instead, focus on what each fund actually does for your portfolio. And if you’re wondering whether a single fund can offer enough diversification, the answer is often yes. Just make sure it holds a broad mix of stocks across sectors and regions, and you may already be enjoying most of the benefits that diversification has to offer.

References

Evans, John L., and Stephen H. Archer. 1968. ‘Diversification and the Reduction of Dispersion: An Empirical Analysis’. The Journal of Finance 23 (5): 761–767. https://doi.org/10.2307/2325312

Financial Conduct Authority. 2021. Client Assets Sourcebook (CASS). London: FCA. https://www.handbook.fca.org.uk/handbook/CASS/

Statman, Meir. 1987. ‘How Many Stocks Make a Diversified Portfolio?’ Journal of Financial and Quantitative Analysis 22 (3): 353–363. https://doi.org/10.2307/2330969

Swedroe, Larry E., and Andrew L. Berkin. 2015. The Incredible Shrinking Alpha: And What You Can Do to Escape Its Clutches. New York: BAM Alliance Press.