Featured and Latest Posts

Inflation Swaps In A Short-Duration Bond Fund

If you want UK inflation protection, the obvious route is index-linked gilts. The problem is that the linker market is relatively narrow and often pushes you into longer-duration exposure, so performance can end up being dominated by real-rate duration and price volatility rather than inflation protection. Dimensional’s design choice in the Sterling Short Duration Real Return Fund is to separate those moving parts: keep the bond portfolio short and diversified (including investment-grade credit), then attach inflation sensitivity via an overlay of UK RPI inflation swaps.

That is the key idea: a physical linker bundles inflation linkage with real-rate duration, whereas a swap overlay lets you target inflation exposure without being forced into long duration. The fund is not risk free. Credit spreads can widen, and implementation frictions matter, but the risk mix is different from a linker-heavy approach.

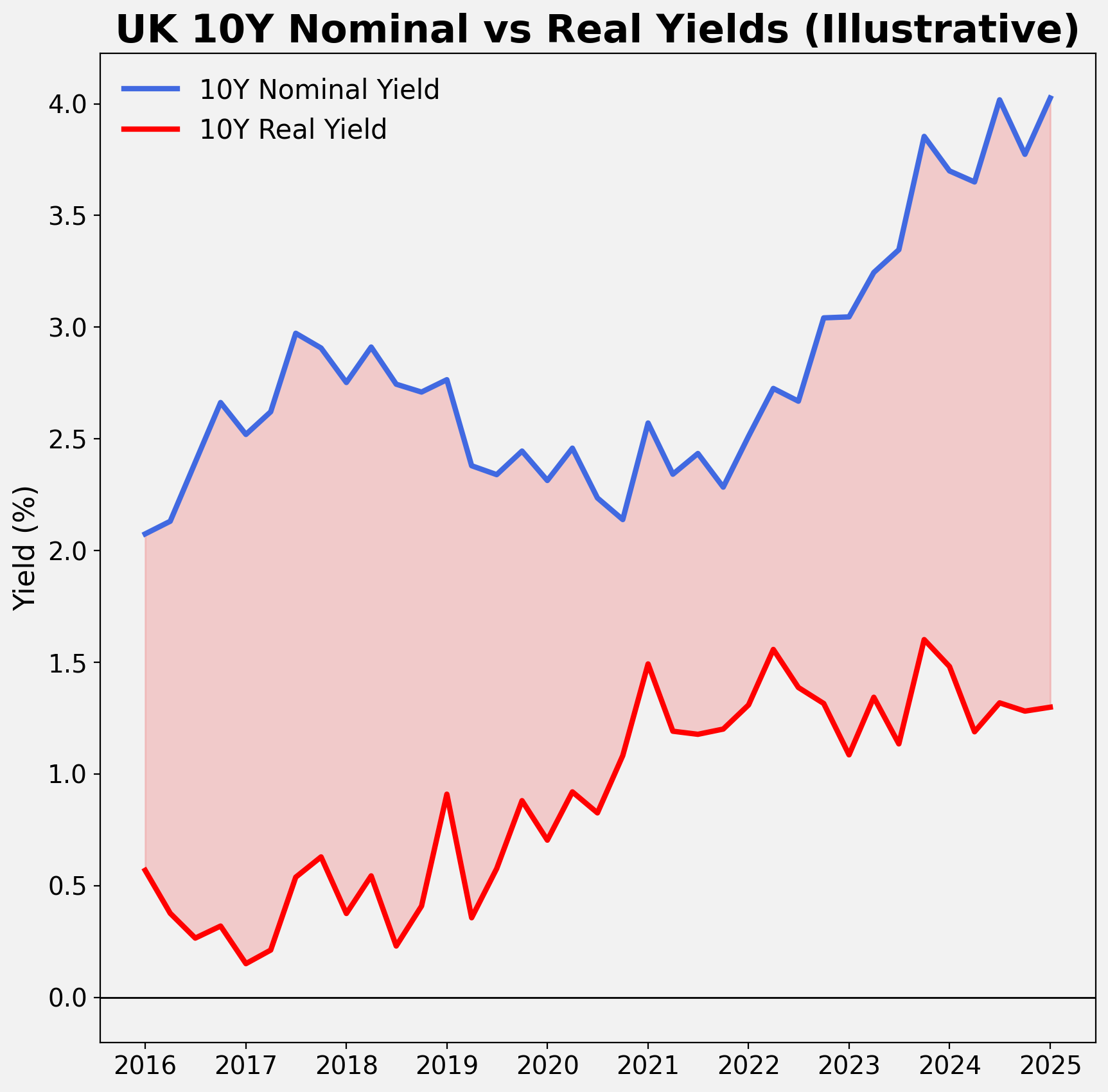

Nominal vs Real Yield Curves: Understanding Inflation Protection

Nominal and real yield curves often appear similar, which leads some investors to assume they say the same thing about interest rates and inflation. In reality, nominal gilt yields include compensation for inflation, whereas index-linked gilt yields are quoted after inflation has already been accounted for. The gap between the two, breakeven inflation, is not a clean read of future inflation because it also reflects liquidity conditions, the value placed on inflation protection and distortions in the index-linked market.

These differences matter for returns. Inflation-linked gilts provide inflation-adjusted cashflows, but their prices remain highly sensitive to changes in real yields. When real yields rise, they typically fall more sharply than equivalent nominal gilts, and any CPI uplift takes time to offset those losses. Inflation linkers work best when inflation risk increases more than expected, not merely when inflation is high. Understanding this distinction helps investors avoid disappointment and use inflation-linked gilts more effectively.

What Equity Returns Really Are

When people talk about ‘equity returns’, they often mean whatever percentage the market delivered last year. That is fine for storytelling, but it is not a definition. A cleaner starting point is price return versus total return: price return is just the change in the share price, whilst total return includes cashflows, typically assuming they are reinvested.

From there, returns can be broken into what must add up mechanically: shareholder yield, nominal earnings growth, and changes in valuation multiples. Yield is broader than dividends alone, because shareholders can also benefit from buybacks and sensible capital allocation, including debt reduction or reinvestment when expected ROIC is attractive. Valuation changes can dominate in the short run, but they are the least reliable piece to ‘count on’, which is why this decomposition keeps return expectations honest.

Cash, Accruals, Intangibles and Sector Effects: What Really Separates Avantis and Dimensional?

Avantis and Dimensional are often grouped together for good reason. Both sit firmly within the evidence-based investing tradition, draw heavily on the academic asset-pricing literature, and reject discretionary stock picking in favour of systematic exposure to well-documented sources of expected return. That shared philosophy is no accident. Avantis was founded by former Dimensional professionals and reflects the same intellectual lineage: factor investing grounded in theory, long-run evidence and practical implementability.

Where the firms differ is not in ideology, but in execution. The key distinctions centre on how accounting data are interpreted and adjusted when constructing value and profitability signals. In particular, two related but distinct debates drive much of the divergence: how profitability should be measured, especially whether earnings should be adjusted to be more cash-like by stripping out accruals, and how book equity should be defined in an economy dominated by intangible assets. Together, these design choices explain much of the subtle but meaningful difference between Avantis and Dimensional, differences that ultimately reflect alternative trade-offs between accounting precision and robustness rather than fundamentally different views on markets.

Good financial decisions aren’t about predicting the future, they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise, evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.