Featured and Latest Posts

Understanding Derivatives: Risks and Rewards

Derivatives are financial contracts whose value is linked to the performance of an underlying asset, index, or rate. Used for hedging, speculation, or market access, they include instruments like futures, forwards, options, and swaps. Futures and forwards lock in prices for future transactions, whilst options grant rights to buy or sell without obligation—offering strategic flexibility. These instruments are traded either on regulated exchanges or over-the-counter, with pricing influenced by factors such as interest rates, income flows, and storage costs. Though derivatives can be powerful tools, they come with complex risk–reward profiles that demand careful understanding.

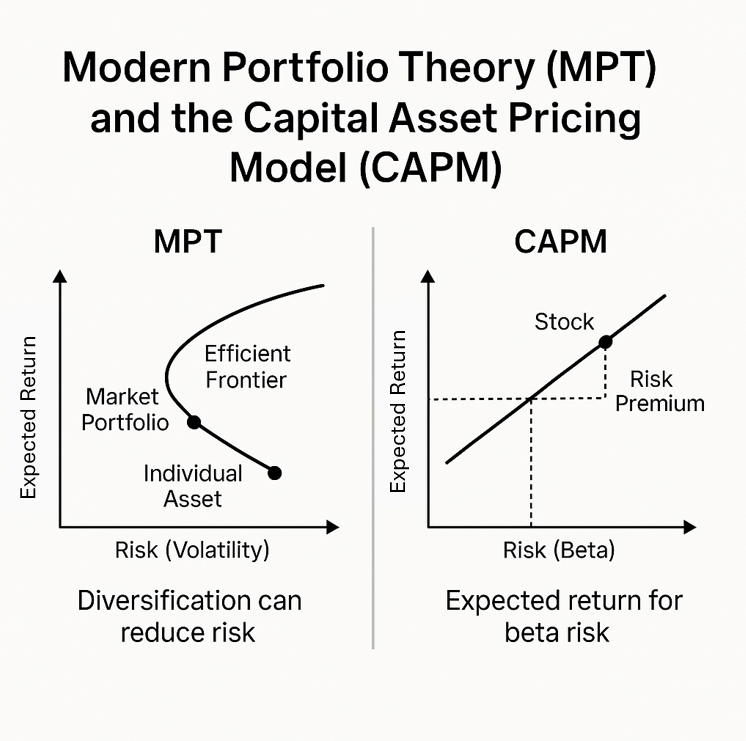

The Foundations of Modern Investing: Why Markowitz and the CAPM Still Matter

Ever wondered how investors decide what a fair return is for taking on risk? Two foundational ideas—Modern Portfolio Theory and the Capital Asset Pricing Model—help explain it. Markowitz shows that smart investing is about how assets work together, not just about how they perform alone. Sharpe built on this by arguing that only market-wide risk (not company-specific risk) should earn investors a return. These theories still shape how portfolios are built today.

Beyond the Three-Factor Model: RAFI, Profitability and the Evolution of Smart Beta

The Fama-French Three-Factor Model (1993) was a milestone in modern finance, offering a more complete explanation of asset returns by introducing size and value alongside market beta. Yet even this expanded framework struggled with persistent anomalies—such as the underperformance of value stocks as defined by the price-to-book ratio, and the puzzling momentum premium.

In this article, we examine how two complementary innovations—RAFI’s Fundamental Indexing and Robert Novy-Marx’s profitability factor—have sharpened the lens through which we view value investing. Each, in its own way, addresses the limitations of traditional value definitions and helps distinguish true bargains from value traps. We also explore the role of momentum in asset pricing and why Fama and French, despite acknowledging its power, ultimately excluded it from their Five-Factor Model (2015).

Together, these ideas illustrate that the future of value investing may lie not in abandoning it, but in redefining how we measure it.

Property or Investment Portfolio? A Deep Dive into UK Buy-to-Let vs Stocks and Bonds

‘If I won the lottery, I’d spend a bit and invest the rest in property.’ That was a friend of mine recently—and it’s a mindset shared by many in the UK. Property feels safe, tangible, and tried-and-true. But is it actually the best place for long-term wealth?

In this post, I break down the reality of buy-to-let investing: the true returns after costs, the friction involved, and how it stacks up against a globally diversified stock and bond portfolio. We crunch the numbers, compare outcomes for a £500,000 investment, and explore why property feels safer—even if it isn’t.

Whether you’re a seasoned landlord or simply wondering what to do with a hypothetical windfall, this deep dive might change how you see the choices.

Good financial decisions aren’t about predicting the future, they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise, evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.