Featured and Latest Posts

Are Bonds Really Safer? Rethinking the Role of Fixed Interest in Long-Term Portfolios

For decades, conventional wisdom has insisted that investors should reduce equity exposure as they age, replacing stocks with bonds to lower risk and secure retirement income. Bonds, after all, are supposed to be the ‘safe’ part of a portfolio—steady, predictable, and protective. But what if that story is not just outdated, but backwards?

A landmark 2025 study by Cederburg, Anarkulova and O’Doherty turns this advice on its head. Using return data from 39 developed countries over more than a century, the authors simulate one million retirement scenarios and reach a striking conclusion: an all-equity portfolio—33% domestic and 67% international stocks—not only delivers higher long-term returns, but also reduces the risk of running out of money in retirement compared to traditional stock-bond mixes. In other words, the asset class long considered the portfolio’s safety net may actually be making retirement less secure.

Yet bonds still have a role to play—not as financial optimisers, but as behavioural anchors. For many retirees, the psychological comfort of owning something stable can be the difference between staying the course and selling out at the worst possible time. The true challenge is not just building a portfolio that performs well on paper, but one that investors can live with when markets test their resolve.

High Yields, Hidden Risks: Why Structured Products Favour the Seller

Structured products promise the best of both worlds: stock market upside with limited downside. It’s a compelling pitch, especially in uncertain markets. But beneath the glossy brochures and bespoke payoffs lies a very different story—one where complexity conceals cost, and the bank always wins. These instruments are engineered using a mix of bonds and derivatives, allowing issuers to extract profit through hidden margins and asymmetric risk. Investors are often unknowingly writing options, capping their upside whilst absorbing significant downside risk. As multiple studies show, the expected returns on structured notes are frequently negative once fees and structural constraints are accounted for. For most retail investors, the allure of structured products is an expensive mirage—cleverly designed to benefit the issuer far more than the investor.

Understanding Derivatives: Risks and Rewards

Derivatives are financial contracts whose value is linked to the performance of an underlying asset, index, or rate. Used for hedging, speculation, or market access, they include instruments like futures, forwards, options, and swaps. Futures and forwards lock in prices for future transactions, whilst options grant rights to buy or sell without obligation—offering strategic flexibility. These instruments are traded either on regulated exchanges or over-the-counter, with pricing influenced by factors such as interest rates, income flows, and storage costs. Though derivatives can be powerful tools, they come with complex risk–reward profiles that demand careful understanding.

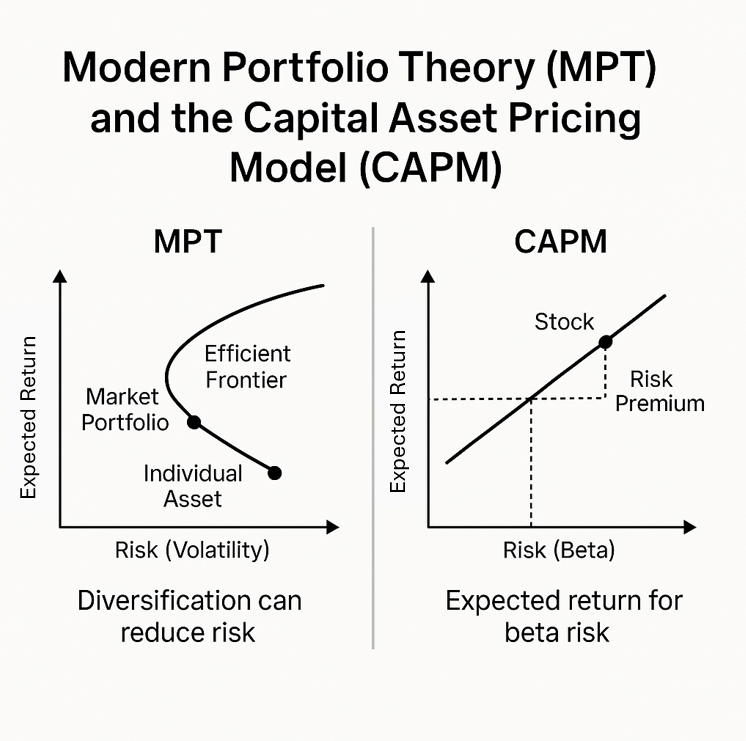

The Foundations of Modern Investing: Why Markowitz and the CAPM Still Matter

Ever wondered how investors decide what a fair return is for taking on risk? Two foundational ideas—Modern Portfolio Theory and the Capital Asset Pricing Model—help explain it. Markowitz shows that smart investing is about how assets work together, not just about how they perform alone. Sharpe built on this by arguing that only market-wide risk (not company-specific risk) should earn investors a return. These theories still shape how portfolios are built today.

Good financial decisions aren’t about predicting the future—they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise—evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.