Featured and Latest Posts

Smarter Indexing, Better Results: 10 Reasons to Consider Dimensional and Avantis

At first glance, portfolios from Dimensional Fund Advisors (DFA) and Avantis Investors may look similar to traditional index funds. They are broadly diversified, low-cost, and systematic in their approach. But beneath the surface lies a crucial difference: these firms are not content with simply tracking the market. Instead, they intentionally tilt their portfolios towards sources of higher expected returns, aiming to deliver performance beyond that of a typical market-cap-weighted index like those offered by Vanguard.

The ESG & Ethical Trade-off: Lower Returns for a Cleaner Conscience?

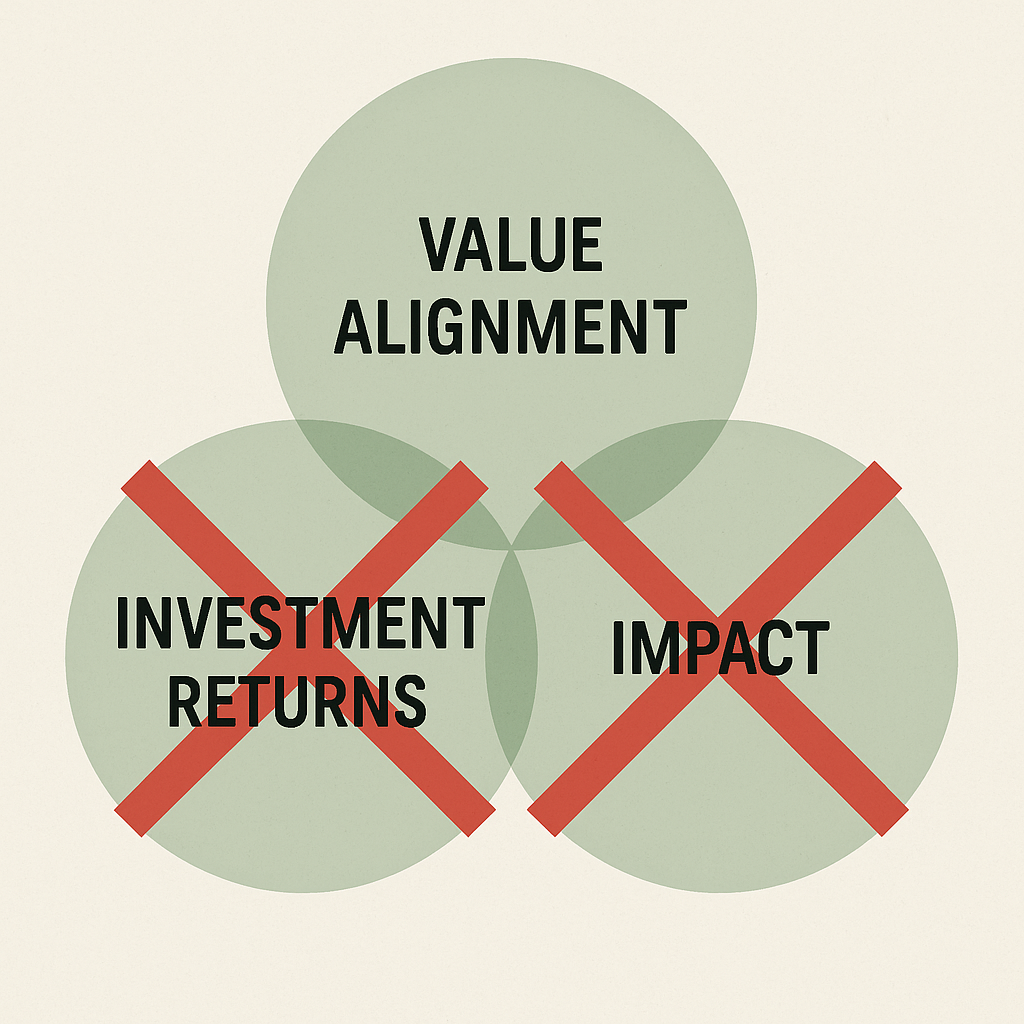

ESG and ethical investing have gone mainstream, but beneath the marketing lies a hard truth: investors must choose between three goals—value alignment, real-world impact, and maximising returns. You can’t reliably have all three.

Avoiding ‘brown’ stocks may align with personal ethics, but it often comes at the cost of lower expected returns. And whilst some ESG funds claim to outperform, much of this can be explained by common risk factor exposures like quality or profitability.

For those seeking real impact, it may be more effective to invest broadly and donate the excess return to high-impact causes. ESG offers peace of mind—but not a free lunch.

Should You Hedge Currency Risk in Your Portfolio?

Currency risk is often overlooked, but for UK investors with global portfolios, it matters — especially in bonds.

For fixed income, hedging is essential. Currency volatility adds equity-like risk to what should be a stable part of your portfolio. And there’s no long-term reward for taking it.

Equities are different. Currency moves and stock returns are weakly correlated, and equity volatility typically dominates. Hedging equity exposure often adds complexity with little benefit.

Rule of thumb? Hedge your bonds, not your equities.

Strategic and Tactical Asset Allocation: A Recipe for Underperformance

Strategic and tactical asset allocation may sound sophisticated, but often leads to sub-optimal investment outcomes—particularly when used by in-house investment managers at financial advisory firms. These strategies hinge on predicting market movements—a near impossible task. Worse yet, they can sometimes be a convenient way to justify unnecessary fund switches and rack up extra fees. The smarter approach? Stick to evidence-based strategies like market cap weighting and systematic factor investing. These are methods grounded in research rather than speculation.

Good financial decisions aren’t about predicting the future, they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise, evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.