Featured and Latest Posts

High Yields, Hidden Risks: Why Structured Products Favour the Seller

Structured products promise the best of both worlds: stock market upside with limited downside. It’s a compelling pitch, especially in uncertain markets. But beneath the glossy brochures and bespoke payoffs lies a very different story—one where complexity conceals cost, and the bank always wins. These instruments are engineered using a mix of bonds and derivatives, allowing issuers to extract profit through hidden margins and asymmetric risk. Investors are often unknowingly writing options, capping their upside whilst absorbing significant downside risk. As multiple studies show, the expected returns on structured notes are frequently negative once fees and structural constraints are accounted for. For most retail investors, the allure of structured products is an expensive mirage—cleverly designed to benefit the issuer far more than the investor.

When Asymmetry Changes Everything: Rethinking Factors in a Frictional World

Factor investing often relies on neat, long–short academic constructions that assume away the messiness of real markets. But what happens when we strip away the elegance and impose real-world constraints—no shorting, limited leverage, and actual transaction costs? Van Vliet et al. (2025) take on this challenge and deliver a striking conclusion: many celebrated factor premia fall apart under friction, but low-volatility survives—and thrives. It is not just an anomaly, but a resilient source of risk-adjusted returns in long-only portfolios. In the debate between factor purity and practical implementation, low-volatility may be the quiet winner.

Discretionary Active Fund Managers or Crystal Ball Psychics?

The idea that discretionary active fund managers can consistently beat the market is fanciful. A stock’s price already reflects all known information—if profits were easy to find, they’d be gone in an instant. Prices only move on unexpected news, and no-one can reliably predict the future. Not active fund managers. Not economists. Not even the weatherman.

Relying on a discretionary active fund manager to forecast the economic fortunes of thousands of companies is like trusting a fortune-teller with your life savings. Instead, use financial science—robust, data-driven, and grounded in decades of research.

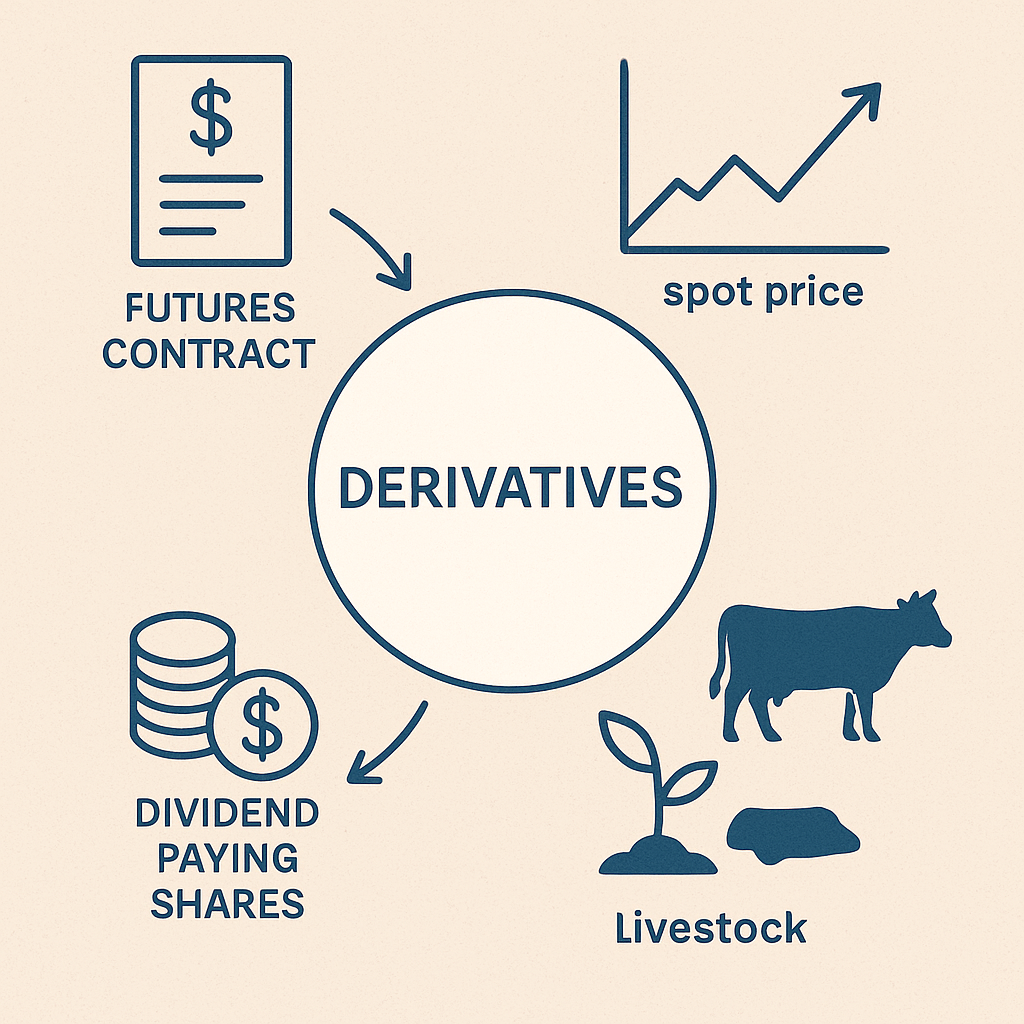

Understanding Derivatives: Risks and Rewards

Derivatives are financial contracts whose value is linked to the performance of an underlying asset, index, or rate. Used for hedging, speculation, or market access, they include instruments like futures, forwards, options, and swaps. Futures and forwards lock in prices for future transactions, whilst options grant rights to buy or sell without obligation—offering strategic flexibility. These instruments are traded either on regulated exchanges or over-the-counter, with pricing influenced by factors such as interest rates, income flows, and storage costs. Though derivatives can be powerful tools, they come with complex risk–reward profiles that demand careful understanding.

Good financial decisions aren’t about predicting the future, they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise, evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.