Featured and Latest Posts

When Asymmetry Changes Everything: Rethinking Factors in a Frictional World

Factor investing often relies on neat, long–short academic constructions that assume away the messiness of real markets. But what happens when we strip away the elegance and impose real-world constraints—no shorting, limited leverage, and actual transaction costs? Van Vliet et al. (2025) take on this challenge and deliver a striking conclusion: many celebrated factor premia fall apart under friction, but low-volatility survives—and thrives. It is not just an anomaly, but a resilient source of risk-adjusted returns in long-only portfolios. In the debate between factor purity and practical implementation, low-volatility may be the quiet winner.

Smarter Indexing, Better Results: 10 Reasons to Consider Dimensional and Avantis

At first glance, portfolios from Dimensional Fund Advisors (DFA) and Avantis Investors may look similar to traditional index funds. They are broadly diversified, low-cost, and systematic in their approach. But beneath the surface lies a crucial difference: these firms are not content with simply tracking the market. Instead, they intentionally tilt their portfolios towards sources of higher expected returns, aiming to deliver performance beyond that of a typical market-cap-weighted index like those offered by Vanguard.

The ESG & Ethical Trade-off: Lower Returns for a Cleaner Conscience?

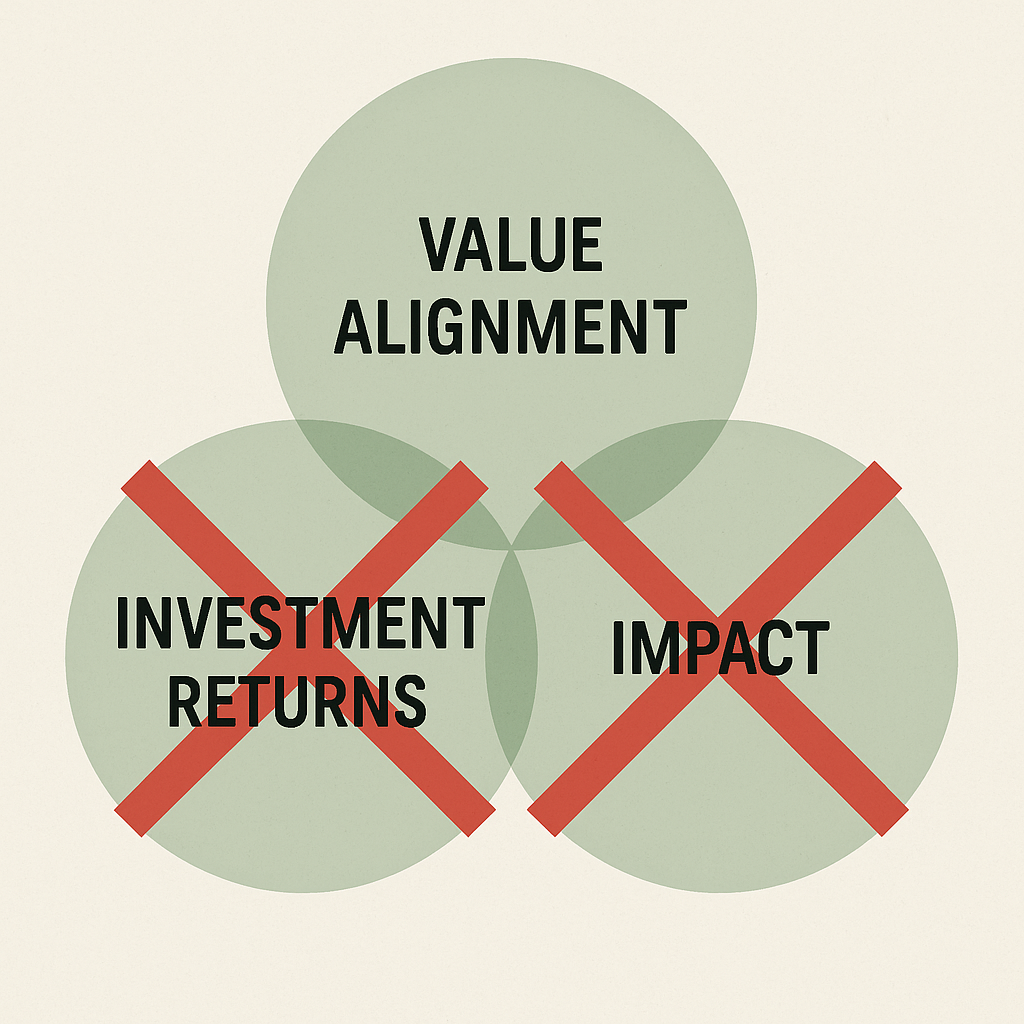

ESG and ethical investing have gone mainstream, but beneath the marketing lies a hard truth: investors must choose between three goals—value alignment, real-world impact, and maximising returns. You can’t reliably have all three.

Avoiding ‘brown’ stocks may align with personal ethics, but it often comes at the cost of lower expected returns. And whilst some ESG funds claim to outperform, much of this can be explained by common risk factor exposures like quality or profitability.

For those seeking real impact, it may be more effective to invest broadly and donate the excess return to high-impact causes. ESG offers peace of mind—but not a free lunch.

Should You Hedge Currency Risk in Your Portfolio?

Currency risk is often overlooked, but for UK investors with global portfolios, it matters — especially in bonds.

For fixed income, hedging is essential. Currency volatility adds equity-like risk to what should be a stable part of your portfolio. And there’s no long-term reward for taking it.

Equities are different. Currency moves and stock returns are weakly correlated, and equity volatility typically dominates. Hedging equity exposure often adds complexity with little benefit.

Rule of thumb? Hedge your bonds, not your equities.

Good financial decisions aren’t about predicting the future—they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise—evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.