Featured and Latest Posts

When Asymmetry Changes Everything: Rethinking Factors in a Frictional World

Factor investing often relies on neat, long–short academic constructions that assume away the messiness of real markets. But what happens when we strip away the elegance and impose real-world constraints—no shorting, limited leverage, and actual transaction costs? Van Vliet et al. (2025) take on this challenge and deliver a striking conclusion: many celebrated factor premia fall apart under friction, but low-volatility survives—and thrives. It is not just an anomaly, but a resilient source of risk-adjusted returns in long-only portfolios. In the debate between factor purity and practical implementation, low-volatility may be the quiet winner.

Discretionary Active Fund Managers or Crystal Ball Psychics?

The idea that discretionary active fund managers can consistently beat the market is fanciful. A stock’s price already reflects all known information—if profits were easy to find, they’d be gone in an instant. Prices only move on unexpected news, and no-one can reliably predict the future. Not active fund managers. Not economists. Not even the weatherman.

Relying on a discretionary active fund manager to forecast the economic fortunes of thousands of companies is like trusting a fortune-teller with your life savings. Instead, use financial science—robust, data-driven, and grounded in decades of research.

Understanding Derivatives: Risks and Rewards

Derivatives are financial contracts whose value is linked to the performance of an underlying asset, index, or rate. Used for hedging, speculation, or market access, they include instruments like futures, forwards, options, and swaps. Futures and forwards lock in prices for future transactions, whilst options grant rights to buy or sell without obligation—offering strategic flexibility. These instruments are traded either on regulated exchanges or over-the-counter, with pricing influenced by factors such as interest rates, income flows, and storage costs. Though derivatives can be powerful tools, they come with complex risk–reward profiles that demand careful understanding.

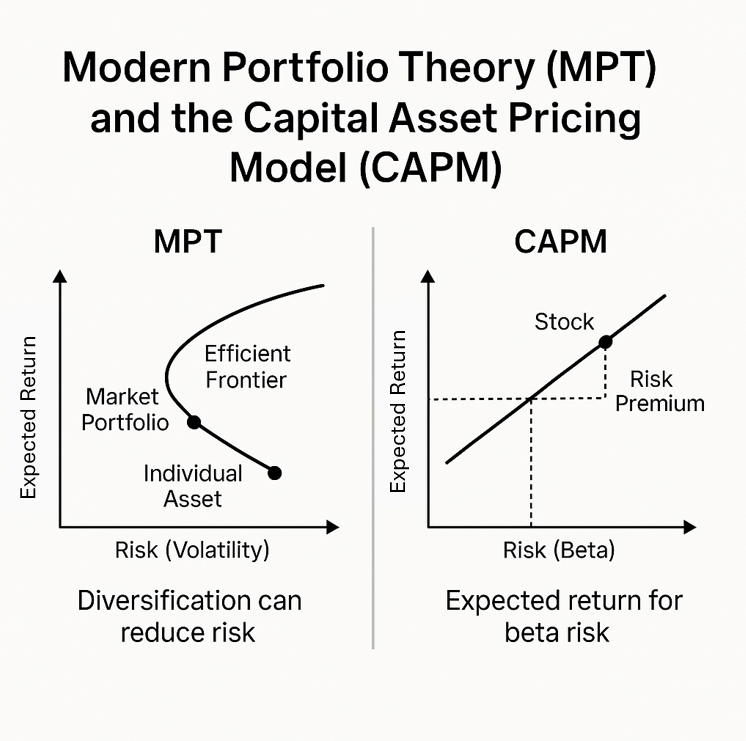

The Foundations of Modern Investing: Why Markowitz and the CAPM Still Matter

Ever wondered how investors decide what a fair return is for taking on risk? Two foundational ideas—Modern Portfolio Theory and the Capital Asset Pricing Model—help explain it. Markowitz shows that smart investing is about how assets work together, not just about how they perform alone. Sharpe built on this by arguing that only market-wide risk (not company-specific risk) should earn investors a return. These theories still shape how portfolios are built today.

Good financial decisions aren’t about predicting the future—they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise—evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.