Featured and Latest Posts

Beyond the Three-Factor Model: RAFI, Profitability and the Evolution of Smart Beta

The Fama-French Three-Factor Model (1993) was a milestone in modern finance, offering a more complete explanation of asset returns by introducing size and value alongside market beta. Yet even this expanded framework struggled with persistent anomalies—such as the underperformance of value stocks as defined by the price-to-book ratio, and the puzzling momentum premium.

In this article, we examine how two complementary innovations—RAFI’s Fundamental Indexing and Robert Novy-Marx’s profitability factor—have sharpened the lens through which we view value investing. Each, in its own way, addresses the limitations of traditional value definitions and helps distinguish true bargains from value traps. We also explore the role of momentum in asset pricing and why Fama and French, despite acknowledging its power, ultimately excluded it from their Five-Factor Model (2015).

Together, these ideas illustrate that the future of value investing may lie not in abandoning it, but in redefining how we measure it.

Property or Investment Portfolio? A Deep Dive into UK Buy-to-Let vs Stocks and Bonds

‘If I won the lottery, I’d spend a bit and invest the rest in property.’ That was a friend of mine recently—and it’s a mindset shared by many in the UK. Property feels safe, tangible, and tried-and-true. But is it actually the best place for long-term wealth?

In this post, I break down the reality of buy-to-let investing: the true returns after costs, the friction involved, and how it stacks up against a globally diversified stock and bond portfolio. We crunch the numbers, compare outcomes for a £500,000 investment, and explore why property feels safer—even if it isn’t.

Whether you’re a seasoned landlord or simply wondering what to do with a hypothetical windfall, this deep dive might change how you see the choices.

The ESG & Ethical Trade-off: Lower Returns for a Cleaner Conscience?

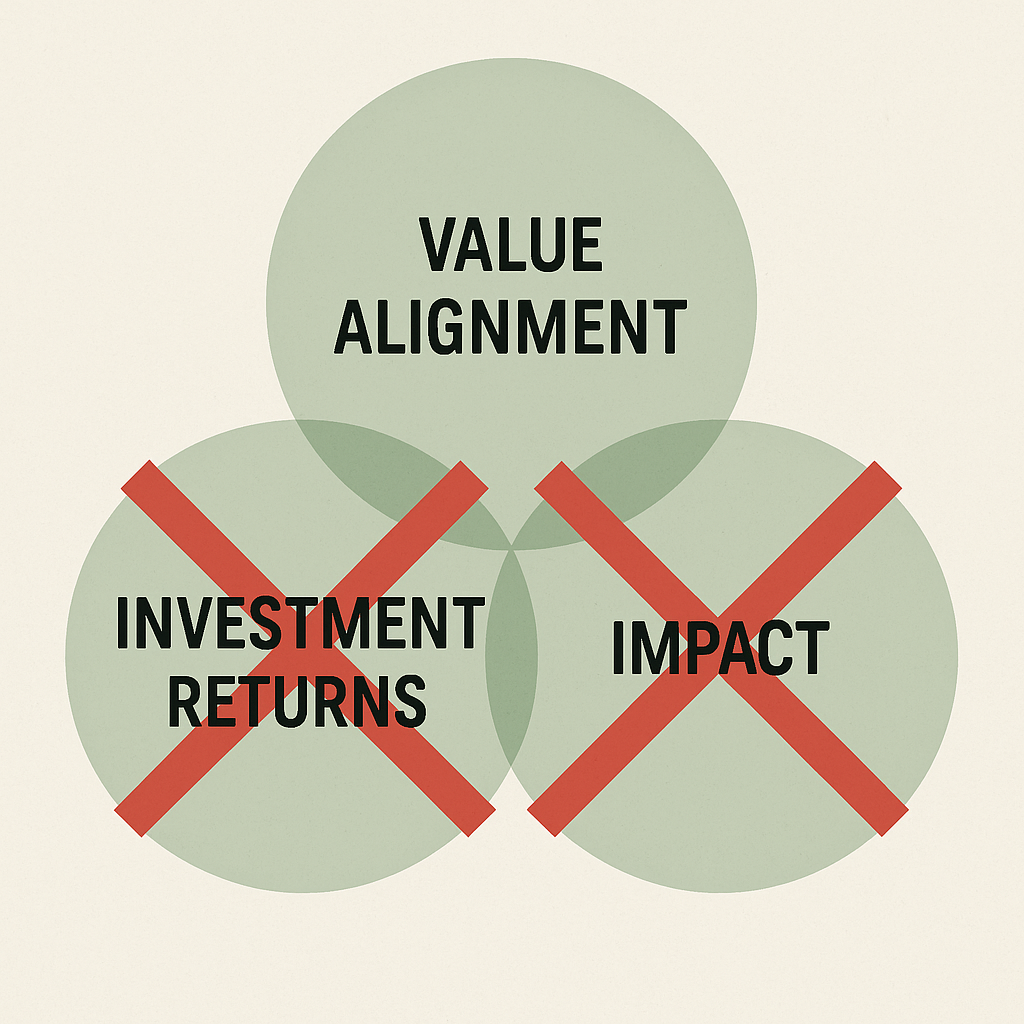

ESG and ethical investing have gone mainstream, but beneath the marketing lies a hard truth: investors must choose between three goals—value alignment, real-world impact, and maximising returns. You can’t reliably have all three.

Avoiding ‘brown’ stocks may align with personal ethics, but it often comes at the cost of lower expected returns. And whilst some ESG funds claim to outperform, much of this can be explained by common risk factor exposures like quality or profitability.

For those seeking real impact, it may be more effective to invest broadly and donate the excess return to high-impact causes. ESG offers peace of mind—but not a free lunch.

When the Essentials Became a Luxury: The Rise of Intergenerational Inequality

Streaming, smartphones, and cheap flights make it easy to believe we’ve never had it so good. But beneath the surface, younger generations are struggling with something far more serious: the essentials have become unaffordable.

For Millennials and Gen Z, owning a home, raising a family, or saving for retirement is harder than it was for their parents—despite higher qualifications and greater workforce participation. Whilst consumer goods have become cheaper, the building blocks of a stable life have slipped further out of reach.

This post explores how that happened—and why the odds feel stacked against the young.

Good financial decisions aren’t about predicting the future, they’re about following a sound process today.

In investing, outcomes are noisy. Short-term performance often reflects randomness, not skill. Yet fund managers continue to pitch five-year track records as if they prove anything. They don’t.

As Ken French puts it, a five-year chart ‘tells you nothing’. The real skill lies in filtering out the noise, evaluating strategy, incentives, costs, and behavioural fit.

Don’t chase what worked recently. Stick with what works reliably.